Sir Bob Jones

nopunchespulled.com

Over the years I’ve watched thousands of commercial property investments, being marketed by real estate agents. That’s their job and I don’t criticise them. Others are flogged by syndicators and such-like.

But I can say with a fair degree of expertise (I bought my first commercial property exactly 60 years ago) that 95% of the offerings won’t make their owners rich.

Perhaps 50% at absolute best, notably geared well-located industrial buildings will hold their value and provide an income. As such they’re an immensely better deal than say fixed interest investments such as Bank debentures and such-like, in which over time the trusting mug purchaser will pay tax on the dividends and lose a fair bit of his or her capital through inflation.

But it’s not my job to critique these offerings any more than it is to barge into a wedding and tell the bride or groom to run for their lives even though statistics say that in at least half the cases of such intervention, that would be superb advice.

However, I simply couldn’t hold my tongue recently when a small Auckland valuation firm decided to float a commercial property entity which they would earn management fees from. The problem with that was these geniuses had come up with a sales pitch angle of mind-boggling ignorance, specifically their acquisitions would be ungeared. This they presented as a plus on utterly specious grounds.

Now I find myself for a second time in my life, unable to hold my tongue re one of the worst property investment propositions I’ve ever witnessed, now being flogged to the public.

This is for an agricultural property fund called NZ Agricultural Property Fund Ltd. It breaks every rule in the commercial investment property book.

It’s so bad if the promotion of dumb deals was a criminal offence then its promoters and directors would go down for life and in some countries, be publicly hanged following an hour long flogging.

I was sad to see it’s chaired by Allan Bollard, a man with impressive career credentials in academia and government, including as Governor of the Reserve Bank. Such sinecures are rewards for public service but frequently lead to embarrassment when they apply to activities the recipient knows nothing about.

Think back to Sir Doug Graham and Bill Jeffries, respectively former National and Labour Justice Ministers, who found themselves in the criminal Court in their capacity as directors of a high interest finance company which went broke costing its mug depositors over $100 million and was run by a fellow with dubious form.

The Crown sought prison sentences but Judge Robert Dobson, probably with a sensible appreciation that he was dealing with bunnies, took a more lenient view.

That said, I well remember during the trial, the prosecutor, Colin Carruthers, bursting into my office crying, “Give me a bloody drink” and so armed, collapsing into a chair. He had been rendered speechless by the following cross-examination of Douglas.

Carruthers: “Sir Douglas; Is it correct Lombard was a commercial property financer?”

Graham: “Yes”.

Carruthers: “Do you know anything about commercial property?”

Graham: “No”.

The Judge, noting Colin was struck dumb by this unexpected but unquestionably honest response, promptly pulled stumps for the day.

In his heyday Ron Brierley controlled dozens of public companies worldwide. He always refused to pay non-executive directors which he was obliged to have, on two grounds, first, that without exception they were useless and second, that a lengthy queue of willing individuals with professional reputations in diverse fields, all sought these roles which they viewed as prestigious.

It was best summed up by Tiny Rowland, a hugely successful businessman who sneered about, “A lord on the Board” practise.

A final investment thought for readers to ponder. On my life-long observation, everybody wants to get rich. But everybody is not rich; ergo; don’t do what everybody does.

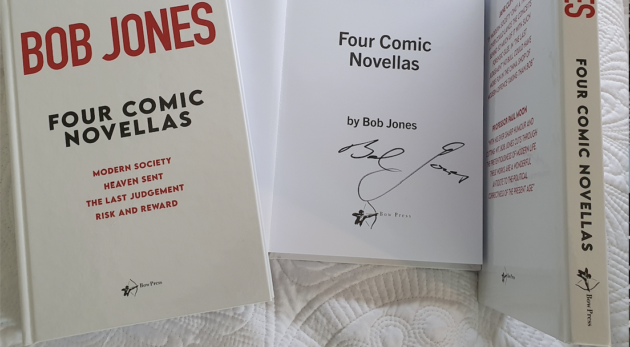

BUY Your Own Copy of Sir Bob’s Latest Book Today.