Once our pioneer ancestors turned tussock or bush into farmland to make a living. Now our leadership is engineering almost the exact opposite and is inviting the rest of the world to help. Sometimes I think of it as a seriously warped scorched-earth policy where the invaders gain fertile land and turn it into a kind of scorched earth – land that is taken out of the economy – then retreat and leave the vanquished with nothing.

Carbon credits demand and supply.

Two recent events triggered me, and I must apologise at the outset for the broad brush approach as my experience in economics is limited. Feel free to correct me in what follows…

1. The leader of the Green party, complete with his retinue, are jetting off to Glasgow for COP26 where they will add little value to climate change concerns by their presence, but still add tonnes of CO2 to the greenhouse gas load that they so abhor.

2. In a rural newspaper I read that an Austrian company has bought a 2018 ha sheep and beef farm at Mt Trotter near Palmerston, for $8.5 million, in order to plant 1,524 ha with trees. Other sales approved by the OIO include a breeding and finishing farm in the Clutha district and a sheep, beef and deer farm in the Waikato.

Reading further, I see that NZ Carbon Farming has bought Hazeldean, a 2,500 ha property which was also a sheep and beef farm; about 1,500 ha will also be planted in trees specifically to create carbon credits.

The carbon credit price reached $65 per tonne of CO2 (1 NZU) on the 22nd of September. As Keith Woodford points out, if financial returns are what matters, the development of carbon credit forests provide significantly higher returns than sheep and beef.

When he wrote that (in August this year), the NZU was “very close to $50”.

You can check on carbon pricing that is influencing these deals at

Here is a graph which sums up the situation.

Government policy.

The Overseas Investment Office is able to approve the sale of land to foreigners if forestry conversion is the aim, and these conversions will inevitably be carbon sinks. This is government policy, even to the point of guaranteeing a profit via the ISDS. When one looks at the apparent conversion of productive, fertile farmland to forests it appears to be the reverse of the pioneer effort to live off the land made productive by bush clearance, ploughing and farming. And this change to carbon farming is not reversible: the carbon trees are forever.

Production forestry is different, but apparently the carbon credit gains are less. In such forests, workers are employed trimming off limbs to avoid knots in timber when the forest is harvested. As this forest can be replanted and the timber tanalised and used in construction, I would like to see figures comparing 100 years of production forestry with 100 years of a carbon farm, both planted with pine. A production forest could have 3 or 4 crops harvested with carbon locked into building frames etc, while the carbon forest grows once.

Native forest replaces pine?

The argument goes that short-lived pine will be replaced by natives. The CCC believe in this. I have yet to see any plan that does this that does not involve felling the pines either physically or chemically. That will be a cost probably not met by the original carbon farmer. Since felled pines may have no commercial value they will rot in place and release CO2, and the carbon credits contract must surely be trashed. By that time the carbon farmer will have gone, his assets will be written off, the profits taken.

The economic damage.

When carbon credits are matched against hill country farm returns, the change to carbon farming is compelling.

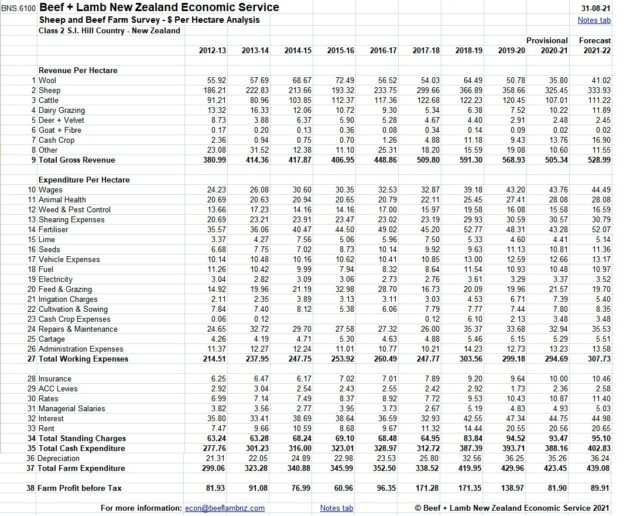

Some are concerned about population decline and I made an effort to quantify this. NZ Beef+Lamb surveyed farmers and compiled spreadsheets that help here.

A quick look at SI hill country farming shows me that a 2,000 ha property might fetch about $164,000 in profit before tax for 2020-21. Choosing expenditure at random, I see wages at $87,500, shearing expenses at $61,140, insurance at $20,000 and rates at $21,740. Payments of these types go into circulation each year. Circulation means, of course, that money moves from hand to hand, paying for food, clothing, shelter etc and it is where this circulation is taking place that is important.

Finally.

Looking at bottom lines I see the total expenses of running a 2,000 ha farm at about $847,000 annually.

A carbon farm will not have anything like that amount returning to the economy and, if the owner is overseas, that is where the profit goes. After 100 years it should be clear whether a carbon forest costing $8.5 million plus setup costs, and forgoing $847,000 circulating money, will be worth it.

If the only money received by the farmer is profit then the farmer is getting about 20% of the annual expenditure. If the farmer accepts $8.5 million for the farm and is clear of debt (to make it simple) then investment returning 1.9% will suffice. This is what Keith Woodford was talking about when he said “if financial returns are what matters”.

It is for the government to decide whether the annual loss of about $847,000 is significant enough to purchase cheaper carbon credits somewhere else. As the forecast price in 2030 is $140, what other farmland in NZ will be turned into “scorched earth”?

Please share this BFD article so others can discover The BFD.