OPINION

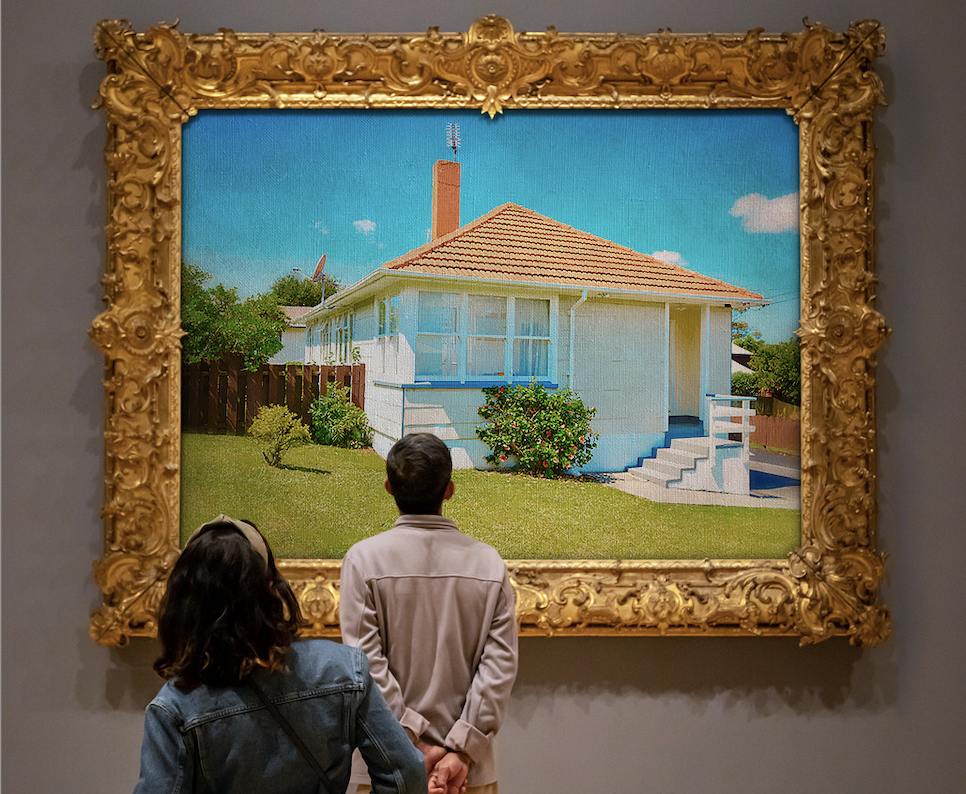

One of the amusing aspects of the last three years has been the rise in real estate values and the chucklesome perceptions which have arisen by so many folk as to how much their house is worth. But could the dam finally be starting to crack? In the nearby town to where I live, Mosgiel, there is a particular street where several houses have recently been listed for sale: perfectly adequate houses people could live in, raise a family and enjoy life. They are all listed at prices beginning with a 4; a contrast to April and June, when a couple of houses in that street changed hands for about $100,000 more.

Naturally, I don’t expect you, dear reader, to have much interest in Mosgiel real estate values – let alone move to this neck of the woods – but it shows the utter twaddle during the last couple of years when prices beginning with a 6 or 7 were just that: illusory and no longer a serious price anybody would pay. One hopes that realism in other parts of New Zealand will return and prices fall to levels which are not incredibly dangerous.

It is significant that Sir John Key, Chairman of ANZ, has realised the bank may well have large piles of toxic horse….feathers sloshing around their balance sheet: million-dollar loans to buy houses for $1.25 million for which the mortgagors won’t be able to afford $1500 per week in interest, on the one hand, and, on the other, when it is doubtful the houses can be sold even for the outstanding mortgage balance. This is assuming you can answer the question: to whom are you going to sell it?

Naturally, nobody takes any delight in people losing their house in a foreclosure (except between Bombay and Wellsford, where the rest of us will be hooting with derisive laughter if lots of ‘up themselves’ Jaffas get their comeuppance) but once again there is an unfortunate historical precedent which is starting to look remarkably like New Zealand 2023.

During the early 1970s the Bank of England, in a rare display of utter madness, printed money at an astonishing rate and for reasons which I have not been able to ascertain. Between October 1970 and October 1973 they printed, wait for it, 900 years’ worth of pounds sterling (i.e. all the money that had ever existed in Britain since William the Conqueror – doubled!). Remind you of anything 2020-2022 NZ Reserve Bank-wise? Oh, but it gets worse, dear reader; 30% of that money ended up being lent or invested in the productive economy – farmers, manufacturers, exporters etc – but the other 70% was used for sharemarket and real estate speculation causing a mindboggling boom. (Starting to ring any bells?)

It predictably ended in tears with a share market crash in 1973, reminiscent of the recent significant drops in sharemarkets around the world, before in 1974 a spectacular property crash which washed away a large number of big-noting spivs and Johnny-come-lately wide boys. We are also facing something similar, or rather, it is difficult to see how we avoid something similar.

Unfortunately, history has a habit of repeating, and God help those with mortgages. Unless I am very much mistaken, you can take the listing price of most houses and knock off, say, 1/3 to give you a better idea of its actual value; now compare that with your mortgage. That 2/3 of its current price is what some cashed-up person will be offering this time next year: possibly the only offer you’re going to get.