Peter Cresswell

pc.blogspot.com

A pandemic does not necessarily cause a recession on its own.

It needs help.

Historically, a pandemic has very rarely caused (or been correlated with) a recession:

Did I say “rarely.” For the twentieth and twenty-first centuries, read “never.” So far.

Why not? Because, as David Ranson explains, “the economic system is resilient in a way that the human body is not”:

Fortunately, the economic damage from an epidemic is largely unrelated to the very serious and tragic number of deaths.

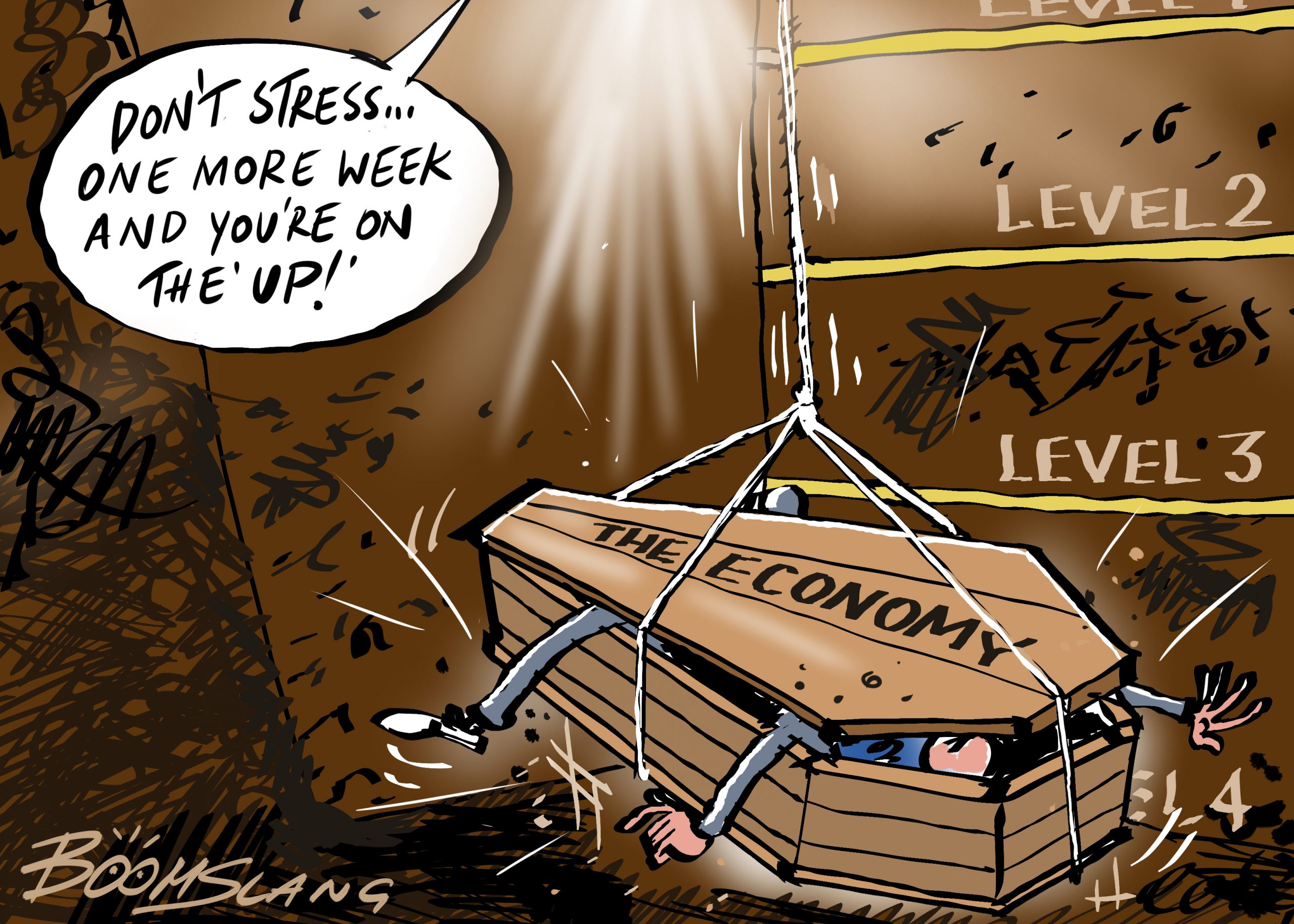

Containment and quarantine efforts mean production shutdowns, and they now are underway everywhere. But they represent supply-side disruptions, very different from conventional “recessions.” …. [S]uch events need not cause much cumulative loss of output—except to the extent that it is self-inflicted.

Self-inflicted? What could he mean by that? Well, things like:

- over-zealous efforts to slow the spread of disease by interfering with economic life;

- rather than coming together, the political parties outbid one another, striving to be seen by the public as proposing the more extreme policy;

- the police powers of the state are invoked and expanded to enforce those policies, which impose excessive and indiscriminate constraints on economic freedoms; and

- going forward—bigger and more authoritarian government; and, of course,

- the Federal Reserve and other central banks (violating their own policies of forward guidance), hitting investors again and again with shock and surprise.

But the economic system is resilient, explains Ranson.

One reason why: because in a supply-side disruption, folk are at least able to save more. Second reason why: because a production interruption like this “destroys no physical capital.”

Nor is the incentive to restore normality harmed. All too few remember the natural adaptive abilities of a free-market economic system to adjust in even the direst circumstances. In the aggregate, gaps in the flow of goods and services are filled by a mix of pre-emptive efforts and ex-post rebuilding. Output dips and vitality are redistributed across sectors. Winners and losers emerge, but there’s no natural reason to fear economic damage beyond that.

Third reason why: because in “anticipating more difficult conditions ahead, b[usinesses boost] production and buil[d] up its stocks of raw materials and unfinished goods”:

So in general, a pandemic alone does not cause a recession.

Of course, this provides no guarantee against this pandemic being the cause of a recession. It provides no guarantee because:

- This pandemic is bigger than all those others; and

- governments are inflicting more damage than in past epidemics, hindering this process of correction; and, even more seriously (and barely acknowledged)

- when this pandemic hit, the world was already in the throes of seeing the bursting of the everything-bubble.

There will be short-term economic damage due to those first two causes. But whatever long-term economic damage comes will primarily be from that third cause. Especially to be feared, the response of government.

If you enjoyed this BFD article please consider sharing it with your friends.