OPINION

Sir Bob Jones

nopunchespulled.com

Students of social and economic history will see ominous signs reminiscent of 1929 currently in America. After the boom 1920s, seemingly overnight it all fell apart leading on to the Great Depression of the 1930s.

From the President downwards, initially, numerous commentators, all, as subsequent analysis showed using the word “fundamental”, assured the public that all was well with the banking system. In the event, those assurances of its “fundamental” soundness proved wrong as bank after bank collapsed, in the process wrecking the wider economy. Today, when you hear the word “fundamental” as an adjective, it’s invariably used to assert something is so sound a proposition as to require no explanation, but always, because the issue is in fact otherwise anything but sound.

Numerous purportedly safe-guard measures were put in place to prevent a repetition. But they failed dramatically in 2008, initially thanks to utterly fraudulent lending practises by some American banks. The consequence of that was money-printing to a degree hitherto without precedent in the pre-Covid decade leading to effectively free money which in turn brought about a speculative boom in asset acquisition without normal economic rationales applying. Elon Musk’s mad purchase of Twitter epitomised this.

When it comes, to money, the inevitable response by the “fundamentalists” and alarmists is “this time it’s different”. But history shows us that’s always wrong. It’s never different, as at root it’s about unchanging human behaviour.

In the last two months, five major American banks have hit the wall and been absorbed by larger survivors. The contagion has spread to Europe with Credit Suisse, hitherto an institution with God-like status, being crushed by fear, leading to a run by depositors.

Now the finger is being pointed at commercial property lending as the principal cause of the US banks’ troubles. Banks love commercial property because of the large amounts involved. This has led to reckless lending there on buildings, often poorly located and now empty through the working from home silliness. It says much about the unprincipled dog-eat-dog ruthlessness of elements in American culture. Even the richest investment property owners, rather than meet the ongoing costs of an empty building, talk of “handing back the keys.”

This involved simply walking away from their obligations and leaving the building to the mortgagee to deal with, despite their financial ability to cope with these costs. But “handing back the keys” is a bit rich. They were never the mortgagee’s in the first place. This is possible as personal guarantees to mortgage debts is illegal as guarantees cancel the virtues of limited liability. Trump has a history of dumping such properties on his lenders which is why no American bank will deal with him.

Add to the currently American contagious banking crisis the massive Federal government debt is now at an unsustainable level. The only way out of that is inflation. To lesser degrees that applies to most advanced Western nations and nearly all African and Latin American countries. All of this augers badly for the next few years. Labour shortages throughout Western economies are ensuring full employment but should, as I suggest is likely, the world cop a massive banking crash, these jobs will quickly dry up.

If I was Methuselah I’d be in on these give-aways, now purchasable at a fraction of their intrinsic worth. But I’m not, far from it in fact so my company concentrates on the safe locations.

In Britain that’s Glasgow where we already own 5 office buildings for which, thanks to their prime location their space is in constant demand. This location surprises some folk. Here are some facts. Glasgow has more office and retail space than any city in Britain, outside of London. In respect of the latter there’s visibly a lot less empty shops than in New Zealand, notwithstanding mad Sturgeon’s lock-down excesses, which almost matched our own.

All of this craziness, apart from making life interesting which if all human behaviour was constantly rational, it certainly wouldn’t be, presents great opportunities. That’s why I’m in Glasgow at present specifically to check out some acquisition possibilities my office there has found.

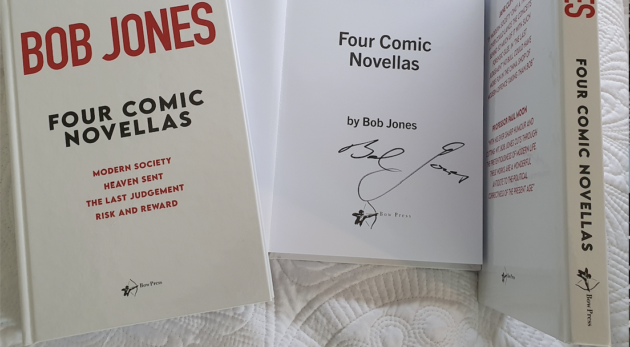

BUY Your Own Copy of Sir Bob’s Latest Book Today.