Bryce Edwards

Victoria University of Wellington – Te Herenga Waka

democracyproject.nz

Dr Bryce Edwards is Political Analyst in Residence at Victoria University of Wellington. He is the director of the Democracy Project.

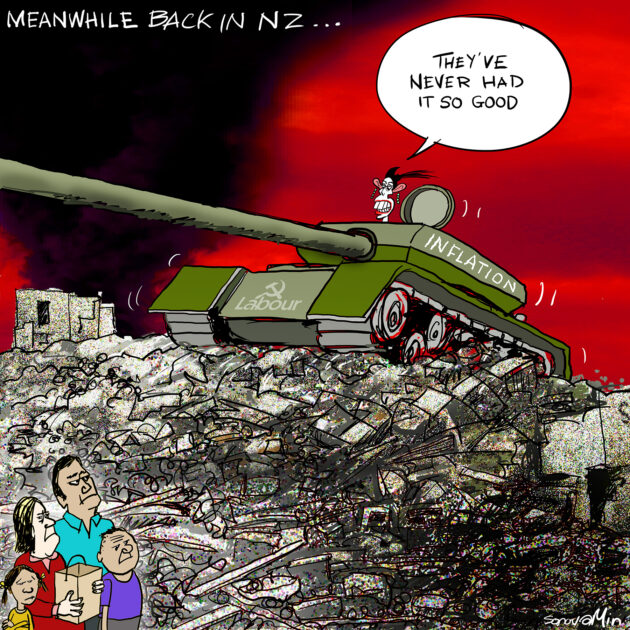

It’s ordinary people who are suffering the most from the current cost of living crisis. In other words, working people and the poor are paying the price of higher prices.

Rising living costs have greater consequences for those in the bottom half of the wealth hierarchy, who are pushed into the type of financial difficulties that politicians and the wealthy just don’t have to deal with. Hence, we are likely to see significant human damage arising from the growing crisis, such as families losing their homes, people paying a higher proportion of their incomes in rent, and having to make difficult choices about which of life’s necessities they can do without when cash is scarce.

The reverberations of this crisis will be felt for a long time – in the form of declining quality of life, worsening health statistics, housing affordability, and so forth.

Accountability and passing the buck

It’s only natural to ask what has caused this situation. It’s an issue of political accountability, to say nothing of the need to learn some lessons and hopefully avoid this occurring again.

Ruling politicians will do all they can to pass the buck and point the finger elsewhere. Minister of Finance Grant Robertson is blaming New Zealand’s inflation on decisions made by politicians in other parts of the world. Of course, he’s partly correct – other leaders have made incompetent and self-serving decisions that are causing global problems, and contributing to our own local cost of living crisis. But that doesn’t let local decision-makers off the hook.

Covid stimulus spending

Although few politicians or even economists want to acknowledge it, the decision to launch massive Covid stimulus spending has played a central role in the current crisis around the world, including New Zealand. Politicians and central banks unleashed a flood of money, but the stimulus primarily drove increases in asset values, thereby making inequality even worse. The K-shaped recovery enriched the already-wealthy, while those without large assets to begin with – houses, share portfolios and so on – are left to struggle with the consequences of inflation.

The massive Covid expenditure may have had some justification – they were trying to ward off a recession – but politicians and the central banks targeted this spending in ways that advantaged the rich, and continued to pour money into those economies well after the Covid economic crisis was stabilised. Similarly, the Government’s Wage Subsidy Scheme was set up to meet genuine need, but poor design saw much of the $20bn flow into the bank accounts of the rich.

Some of these criticisms can be more easily made in retrospect, but much of it was also obvious at the time. For example, even Treasury warned the Minister of Finance in early 2020 that the proposed Covid stimulus policies would produce worsened inequality.

Economist Professor Arthur Grimes of Victoria University of Wellington has been scathing today about what has led to current inflation levels and the cost of living crisis. Grimes has been both Reserve Bank chairperson and its chief economist, and he’s also credited with creating the innovative practice of “inflation targeting” in the 1980s, which helped get inflation down near zero. What he says carries a lot of weight.

Grimes has not minced his words about the Reserve Bank: “They’re completely to blame for allowing this to happen… They’ve been incompetent, they’ve been really incompetent”. And he’s been reported by Thomas Manch as believing “with better management, New Zealand could’ve had inflation akin to Switzerland, at 2.9%, or Japan, at 2.1%.”

Manch reports Grimes’ explanation for the domestic inflation disaster: “the Reserve Bank had ‘misread the conditions’ of the Covid-19 pandemic and in the past three years, it had loosened monetary policy too much, causing a massive increase in asset prices, and cut the official cash rate ‘more than they should have’.”

According to Grimes, ordinary people will now suffer: “There’s going to be people who made plans and interest rates are going to be a lot higher than what they budgeted on, and they’ll have to be higher, because of the mistakes the [Reserve] Bank’s made, and it’ll catch people unawares: bankruptcies and people losing their houses”.

Are the politicians also to blame?

To what extent are the politicians to blame? Grimes points the finger at the 2018 decision to water down the Reserve Bank’s sole target of controlling inflation, by adding employment stability as another goal. He says that Labour “completely mucked that up”.

Financial journalist Bernard Hickey has also written today about the central role of the Reserve Bank, saying they “should be first in the firing line”, and pointing out that Grant Robertson should also be held accountable, because he signed off the money printing, the cheap bank lending, and the removal of LVR controls in 2020.

Hickey argues that initially some of the $100bn money printing and other loosening of monetary policy was understandable, given the circumstances. However, he argues this direction should have been halted soon after the first lockdown, especially when it became apparent that the economy was bouncing back strongly, and house prices were rocketing upwards.

Although some other countries made the same mistakes, Hickey says the New Zealand mistakes were worse: “the Reserve Bank had already printed as much, if not more, in proportionate terms to GDP, than those other central banks, and took the extra step of relaxing LVR controls.”

What can now be done? First, Hickey says New Zealand should initiate a review like Australia: “There must be a serious, deep and independent review of the Reserve Bank’s actions in 2020 and 2021, if only to win back the trust of the generation of renters (without generous parents) who are now fleeing to Australia to find renewed hope of home ownership and family lives.”

Second, the Reserve Bank “could start by ending and unwinding the $12.7b of cheap loans to banks through its Funding for Lending programme. It could also further tighten LVR settings and unravel its bond-buying programme much faster.”

What else could the Government do? A Windfall Profits Tax?

Acknowledging that the current crisis is largely one of quickly increasing wealth inequality, Labour could act like a traditional party of the left and redistribute wealth in a significant way, perhaps even implementing a Windfall Profits Tax. Even the British Conservative Government has recently announced such a tax on UK oil and gas profits to partly fund cost-of-living support to households.

New Zealand corporates have certainly been highly profitable during the last two years, profiting from the Government’s stimulus policies while workers have been squeezed and the cost of living crisis has been biting hard.

According to researcher Edward Miller, of First Union, Treasury’s corporate tax data shows that in “the year to March 2022, corporate profits in this country had spiked by a pretty staggering 39 percent” or $20 billion dollars. Miller says: “Profits jumped up to $72b in that most recent year. They hadn’t been at that level prior. And it’s the biggest increase that we’ve ever seen, both in terms of the raw dollars, whether that’s inflation adjusted dollars or non-inflation adjusted dollars, and it’s also the biggest percentage increase that we’ve seen, ever.”

Miller points to sectors such as banking, construction, and supermarkets where there is very little competition, that could easily pay a windfall tax given their mega profits over the last two years.

By contrast the Government’s current cost-of-living strategies seem feeble. In particular, the announcement on Sunday of an extension of the transport subsidies has been widely seen as cynical. As broadcaster Tova O’Brien says today, the fact that the unscheduled press conference was called on Sunday just prior to the following day’s announcement of the inflation rate, shows how rattled Labour is, and how ill-equipped to deal with this crisis.

O’Brien has rightly called for the Government to take the crisis seriously and develop some proper measures: “It’s time for some long-term planning. It’s time for the Government to start looking seriously at fare-free public transport in perpetuity rather than saving it up as an election bribe. Or a tax-free threshold on income. Or anything – any decent long-term policies that the Government’s army of officials can muster.”

If such steps aren’t taken, or if Labour feels the need to implement austerity measures – as some politicians on the right are urging it to do – things are likely to get much worse.

Inevitably some will try to blame wage increases for inflation, despite all the evidence showing that wages are not driving the crisis. But certainly, wage increases will soon be the central focus of the situation.

As economist Arthur Grimes says, workers’ wages need to increase by at least the level of inflation, or they are effectively getting a wage cut: “This is going to be a real problem. It really is a choice now between wage earners suffering by not getting 7% wage increases, or, if they do get 7% wage increases, it’s just gonna keep on pushing up future inflation. So it’s just going to be a mess, whichever way it goes.”

The problem is that none of the political parties seem interested in fixing any of this. They are more likely to continue to argue futilely about whether the inflation problem is due to global or local issues. It’s time to move beyond that debate and find some local solutions.

This article can be republished under a Creative Commons CC BY-ND 4.0 license. Attributions should include a link to the Democracy Project.