Below is an article I have written on the fact that future power supplies are at risk from high prices and blackouts. When I sent it to the NZ Herald, the Listener and the NBR they didn't respond. I assume that they figured it would upset the government. Which is probably true.

Bryan Leyland

Bryan Leyland MSc, DistFEngNZ, FIMechE, FIEE(rtd) is a power systems engineer with 60 years experience in New Zealand and overseas. He and his wife are majority shareholders in a small hydropower scheme that benefits from the shortcomings of the electricity market.

Power prices are skyrocketing overseas: will it happen here? Power prices in the UK and Europe have more than doubled over the last 10 years and are now increasing more rapidly. Millions of people in the UK can no longer afford electricity.

Why has this happened? Key factors are the belief that heavily subsidised wind and solar power is a cheap and effective way of reducing emissions of man-made greenhouse gases. Also, the premature closing down of safe and emissions-free nuclear power stations is exacerbated by flawed electricity markets that make low-cost base load generation uneconomic. Then there is Russian-funded hostility towards fracking and increased dependence on Russian gas until the invasion of the Ukraine suddenly limited its supply.

Prices in Europe have trebled in the last year further driving up electricity prices. European and UK power prices are now so high that many countries are increasing taxation in order to subsidise electricity. The same has happened in Australia where subsidised rooftop solar has resulted in high and fluctuating power prices.

In spite of huge amounts of cheap coal, Australian power prices are now much the same as European power prices. What does this mean for New Zealand?

Unless drastic action is taken we cannot avoid substantial price increases and an increased risk of blackouts driven by a shortage of generating plant, limited gas supplies, the increase in the price of coal, the flow on effects of the rapidly increasing carbon tax, and a flawed electricity market.

The recent grid emergency that drove prices as high as $1.50/kWh because there was effectively no wind generation signals the new normal. Investment in gas fields is needed to ensure we have enough for peak demand generation in the evenings when the wind is not blowing for base load generation.

To minimise the risk of dry year shortages we need to build about 1000 MW of gas-fired generation in the next few years and hope that industry and the methanol and urea plants will reduce gas consumption when demand is high. The price will be high because the Ukraine situation has increased methanol and urea prices. The cheapest alternative is for the consumers to pay the annual costs of keeping gas in storage. The market needs to change to do this.

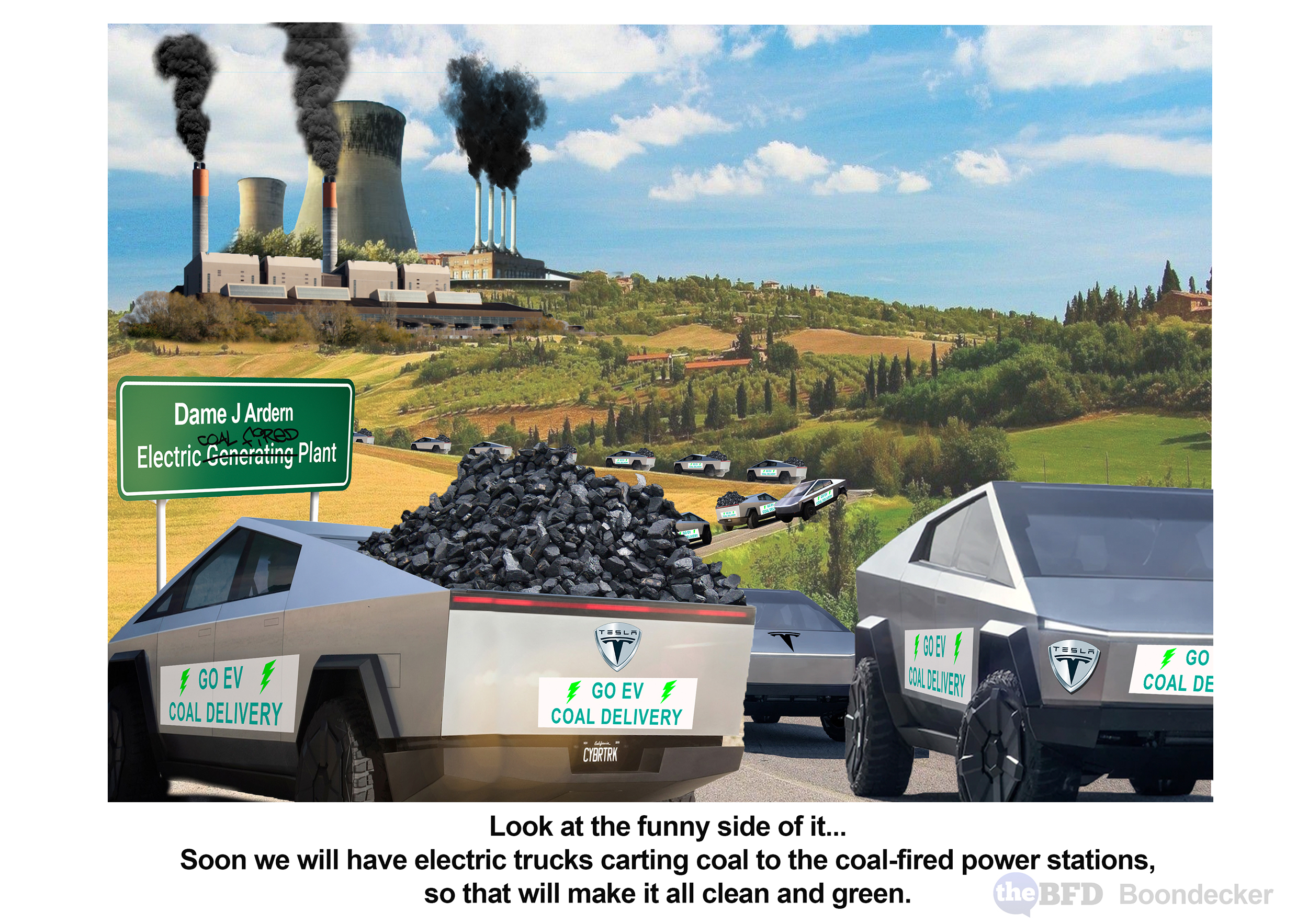

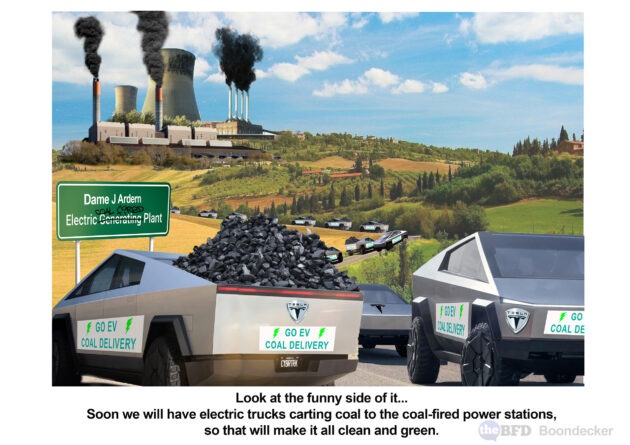

As a result of the gas shortage, the Huntly power station is burning more and more coal and it has been running most of the time since 2017. The indications are that Huntly will be needed for years. The fact that the more gas we have, the less coal Huntly burns, seems to be beyond the comprehension of the Government. (For the same amount of generation, Huntly emits twice as much CO2 as a gas-fired station.)

The electricity market combined with the carbon tax disproportionately drives up electricity prices. At the moment, the carbon tax is about $75/tonne of CO2 and the Climate Commission predicts that it could go as high as $250/tonne. Every $50 increase in carbon tax increases the cost of generation at Huntly by at least 2.5¢ and 1.5¢ at a gas-fired station. The market pays every generator the same price that it pays to the most expensive generator selected to run. If the increased carbon tax drives the wholesale price from, for instance, 15¢ to 17.5¢ all the low-cost hydro stations get windfall profits. The consumer eventually pays.

The market turns the carbon tax into a gigantic rort that results in the hapless consumer paying carbon tax on hydropower!

The electricity market promised to bring us cheaper electricity. It didn’t. Between 2004 and 2018 wholesale electricity market prices increased at a rate above inflation – from about 7¢ to about 10¢. In 2018 prices jumped to about 15¢ and have been relatively steady at more than 20¢ for the last two years. This doubling of the wholesale price is already showing up in commercial and industrial tariffs, and retail tariffs must soon increase.

Before the electricity market was invented the primary consideration of the power planners was to make sure that we had enough electricity during a dry year when hydropower generation drops to about 50% of normal during the critical 4-month period.

Now there is no one responsible for ensuring that we have sufficient generation to meet dry year demand at a reasonable price. No one.

So what can be done? The arbitrary decision to shut down gas exploration has, perhaps permanently, scared off overseas explorers. All the government can now do is promote increased production at existing fields and maximise the amount of gas stored for dry years at Ahuroa and Tariki in the hope of reducing coal burning at Huntly and minimising the risk of shortages.

Europe has declared that gas is ‘green’ for as long as coal is being burned. The electricity market must be reformed so that someone is responsible for ensuring that the power price reflects the real cost of generation at individual power stations. It must also ensure that the lights stay on during dry years.

Wind and solar farms, not the consumers, should pay for the backup they need when the sun is not shining and the wind is not blowing.

Domestic electricity price rises in the region of 30% and a high risk of shortages are virtually inevitable. Further substantial increases can be avoided only if the government increases the gas supply, reforms the electricity market and promote geothermal, hydro and, maybe, nuclear power. If it doesn’t, excessive electricity prices will turn the country into an impoverished primary producer.