Mary

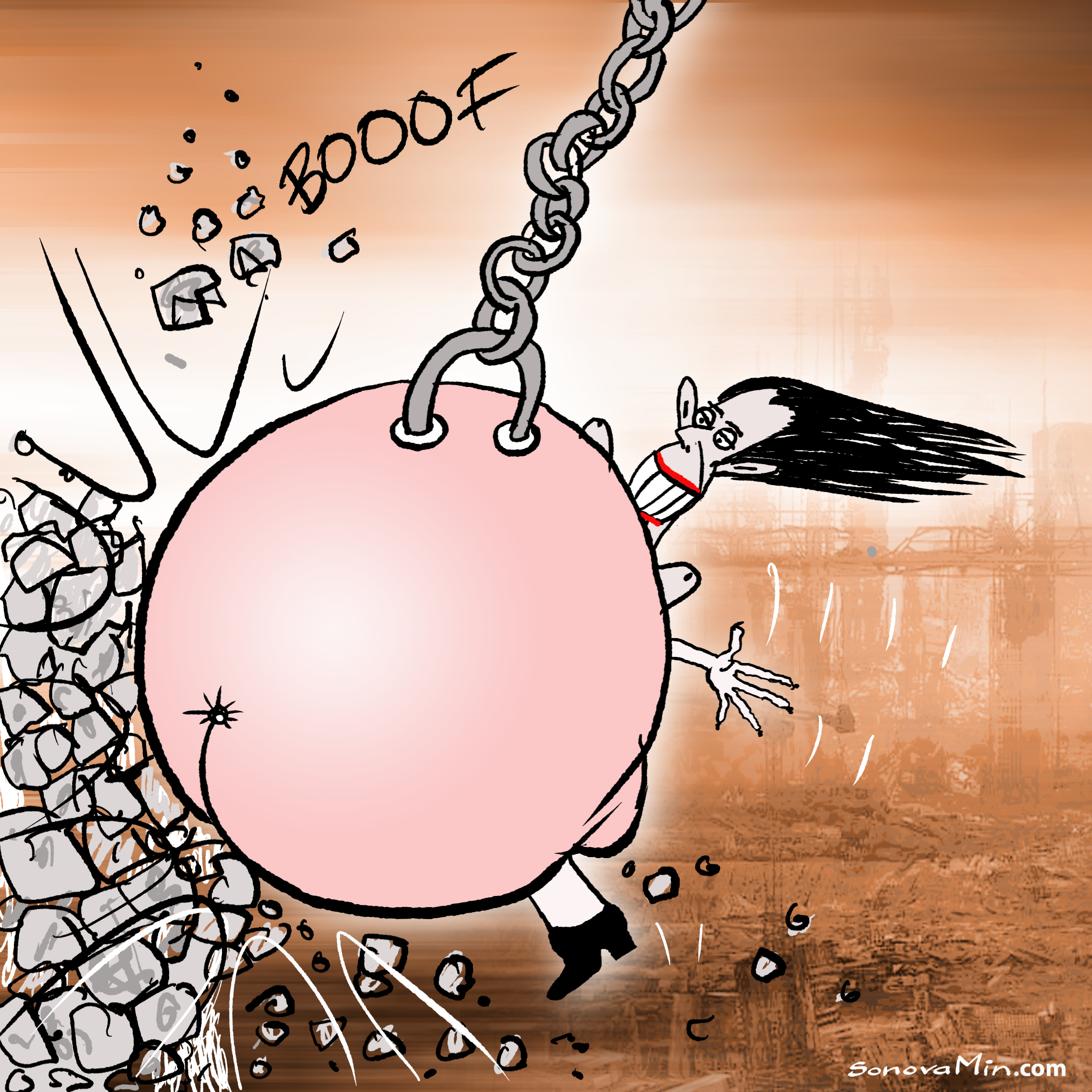

Be careful of what you wish for. The labour government taking a wrecking ball to property investment may well have very nasty side-effects.

It is not rocket science that any landlord not able to recoup their costs via tax deductions must instead increase their income to cover their costs – or go broke. Higher rents will follow as sure as night follows day. How is that going to help renters? How is that going to help renters to save for a deposit to buy a property when incomes are static? How is it going to increase the supply of rental properties when landlords exit the market?

What is even more of an approaching train wreck is a fall generally in the value of properties – the carnage could be nasty. Yet it appears that this is what the government is trying to engineer.

Many recent homeowners have entered the market thanks only to record low interest rates and the ability to purchase on low deposits. These people have minimal equity and any drop in value accompanied by a rise in interest rates would see them literally walk away from their properties. It has happened before and can happen again.

In the last few years of the 1980s, mortgagee sales were carried out in record numbers as those who had purchased with low deposits were hit by increased interest rates and a flat economy. Properties were selling at tens of thousands of dollars less than what was owed to the lender. It was not unusual for a property with a mortgage debt of $200,000 to sell for $145,000. The trigger was usually the loss of a job or fewer hours worked. Interest rates would only have to go up a per cent or two to tip many people over the edge.

It has been the Labour government’s own policy that has enabled people to enter the property market with small deposits. This was an attempt to keep the market afloat when it was at risk of crashing because of the decision to lock down the country. It is a vicious circle of failed policy leading to more ill-thought-out policy doomed to failure.

Rather than hitting investors, the basic problem of supply and demand needs to be addressed. Where are the reforms to the Resource Management Act making it faster, cheaper and simpler to subdivide land for housing? What is needed is to increase the supply of residential-zoned land for houses, and it must be more attractive for developers and investors to enter the market.

Punishing investors won’t help anyone, particularly the low-income family renting in South Auckland, Gisborne, Tawa or Waitara. Many are already at their limit of what they can afford in rent.

What we have just seen is the sort of policy we can expect from a government of party hacks and unionists, none of whom have ever run a business or operated in the real world.

Please share so others can discover The BFD.