The National Party has been admonished for its election advert claiming that retirees would pay $140 per week if a wealth tax was introduced.

Let’s take a look at that figure, shall we?

If a little old lady lived in a house in Auckland worth $1,730,000, then she would find herself liable for $7,300 in wealth tax every year. That equates to $140.38 per week.

Not so fanciful then, is it? Sure, it may have been a mistake to be quite so specific, as everyone’s circumstances will be different, but there will be a lot of elderly people, living in average Auckland homes who will find themselves in this situation, or something very similar.

The complainant, Adam Currie, climate activist and general communist, claims that this type of advertising is “hurting our democracy”. Personally, I think putting the elderly into poverty for the sake of some wild claims on the climate is much worse, both for democracy and for the general well-being of the population.

Trouble is, once an idea is raised, no matter how silly it is, in this day and age, it seems to gain traction.

New Zealanders are likely to face new taxes on wealth and assets such as houses within the next decade as social pressures force Government to move on growing inequality between homeowners and renters, a leading economist says.

Westpac has released its latest economic overview, in which chief economist Dominick Stephens said the economy had shown its resilience in “fine style”.

The bank now expects unemployment to peak at 6.2 per cent, about the same as in 2009.

The recent run of house price growth was not likely to be a short-term trend, Stephens said. He expected house price inflation to be tracking at 15 per cent by mid next year.

The recent run of house price growth is a simple case of supply and demand, as I would expect the chief economist of Westpac Bank to understand. Build enough houses to reduce the demand and the prices will go down, or at least they will stall… Economics 101, dear boy.

In the article, he put capital gains tax and wealth tax in the same category. This is what the media will do until we have all become used to the idea of one, or both, taxes coming into existence.

I want to make it clear that I have no objection in principle to a capital gains tax (CGT) but it has to be done correctly. First and foremost, it must apply only to assets purchased after the date of the introduction of the tax.

Why? Because it is unfair to force a tax on people who made asset-buying decisions when such a tax was not in existence. So, to be completely equitable, all assets owned before the date the tax is introduced should be exempt of the tax. Everyone purchasing assets thereafter will be aware that they may be subject to CGT, unlike those who purchase assets at the moment.

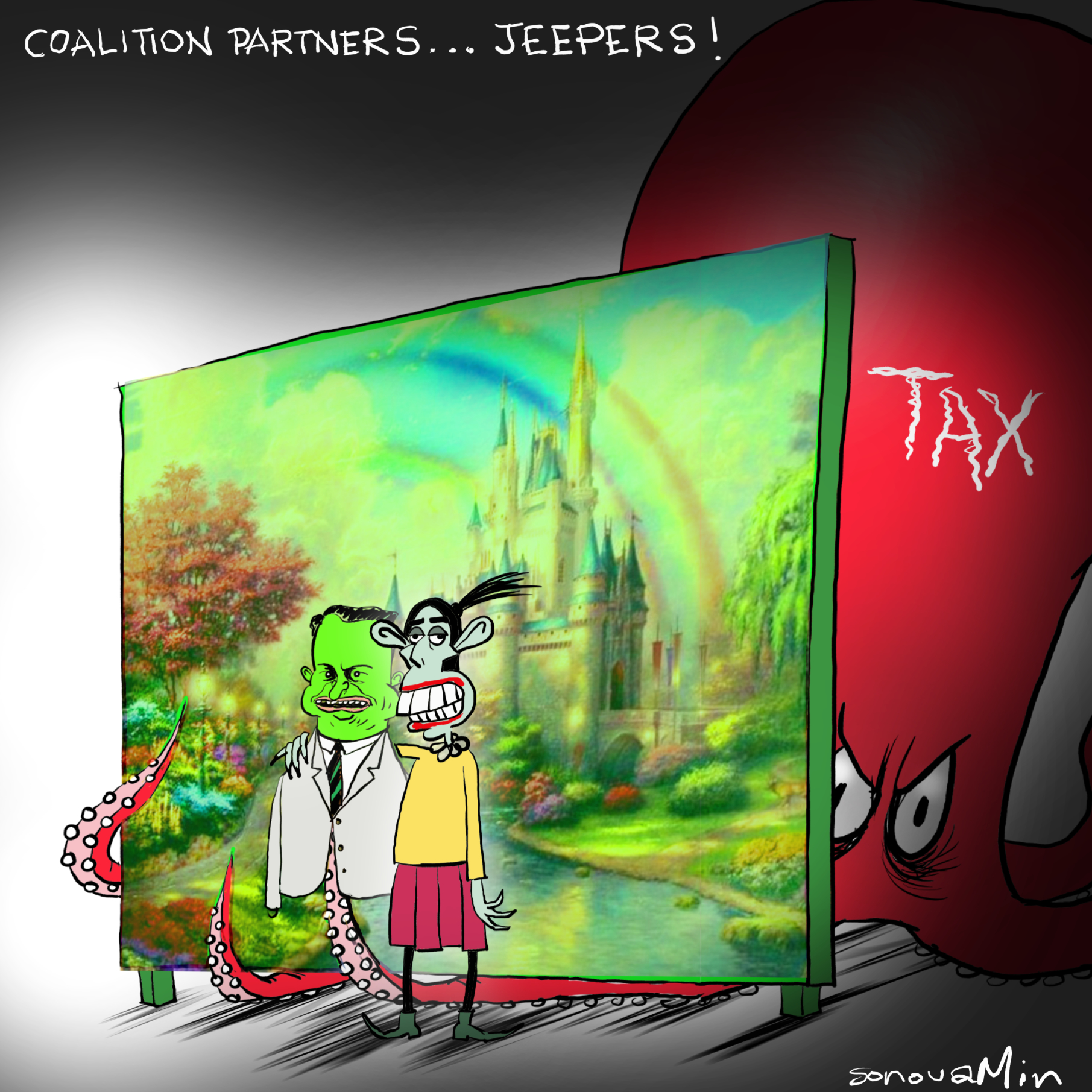

The BFD. Photoshopped image credit Boondecker

I can hear Golriz and James Shaw shrieking from here, but if it is fairness that they want, then this is a mandatory aspect of the introduction of the tax.

Secondly, there must be an adjustment for inflation. Inflation erodes the value of money, so it is unfair to force people to pay tax on inflation. And I don’t mean the silly inflation figures we have at present, based on a basket of goods that excludes the most expensive items – houses, rates, insurance, all of which seem to increase exponentially year after year. I could be forgiven for thinking that the inflation figures are based on things like the cost of bicycle pumps or spinning jennies, but I am assured this is not the case. Exactly how we find ourselves paying higher costs for just about all of the essential things, such as rates, insurance, power and food when we are assured that inflation is below 1% is something I simply do not fully understand. Perhaps Mr Stephens could enlighten me.

Thirdly, it is all very well for Dominic Stephens to talk about wealth taxes when it is partly the banks who are to blame for the overheated housing market anyway. We have the lowest interest rates of all time. The banks could do a number of things to cool the housing market, but they won’t. Cheap money means increased demand for houses. Paying a mortgage is much better value than paying rent these days, which is, of course, part of the problem.

But no. Wealth taxes are on the way. Everyone is doing their best to normalise them so that there will be no resistance next time around. Note how they are all bundled together as ‘wealth taxes’. There is a strong implication that these are taxes that are only going to be imposed on the wealthy and that’s okay, isn’t it? Those mean nasty landlords deserve it, don’t they?

Maybe they do. I can’t answer that. But the little old lady with her Auckland house worth $1,730,000 definitely doesn’t deserve it, does she?

Please share this article so that others can discover The BFD