I’ve come across a few ‘tax experts’ in my time. I’m sure there are a few good ones, but for most of them their expertise is concentrated in a very specific area, and their general tax knowledge is fairly average. But tax experts, particularly those who are partners or senior associates in accounting firms, need to make sure they comment only on tax policy and its effects, and not wander into the world of politics. You’ll see what I mean.

The ability of property investors to claim loan interest costs as an expense against their rental income is being phased out.

It has been estimated that this will cost investors about $6000 a year per $600,000 rental property. Budget documents showed that Treasury estimated the full removal of deductibility in the 2018/2019 tax year would have generated an extra $800 million or more in tax.

But Robyn Walker, a tax partner at Deloitte, said it was an opportunity to right an unfairness for people in the middle income brackets.

Implementing solutions which reduce the tax barriers to more people actively joining the labour market should be a priority.

Inevitably this comes with a fiscal cost, but at the same time, there will be an immediate payback from the improved productivity and profitability and therefore taxes, of the businesses who can fill staffing gaps. The additional tax to be collected from the proposed changes to the tax deductibility of interest for residential property can help pay the bill.

Stuff

Right. So a so-called ‘tax expert’ wants to transfer some of the tax gathered by penalising landlords, making them the only business class not allowed to claim interest on borrowings, and she thinks it would be fair to apply the tax revenue gained to paying extra tax credits to those who have recently rejoined the workforce, or to those collecting Working for Families, to make life easier for them?

My answer to that is simple. The government can fund this if they really want to. They are splashing money around like there is no tomorrow anyway. However, I don’t want to see an increase in the thresholds for rebates such as Working for Families. When John Key did that, he started to lose my support. This so-called ‘tax expert’ does not seem to understand that Working for Families is one of the things that is suppressing wages now. Because employers can hire workers with families who don’t want high wages because they lose their tax rebates, this suppresses all wages in that category.

Do you not think a so-called ‘tax expert’ who wants to see a ‘fairer’ system ought to understand that?

She clearly fails to see another problem on the horizon. This attack on landlords is likely to cause more of them to sell up. Yes, this will mean that there will be more houses available for first-time buyers, but there are always people who need to rent… and such blinkered policies are only going to reduce the supply of rental housing, and increase the government’s homelessness problem.

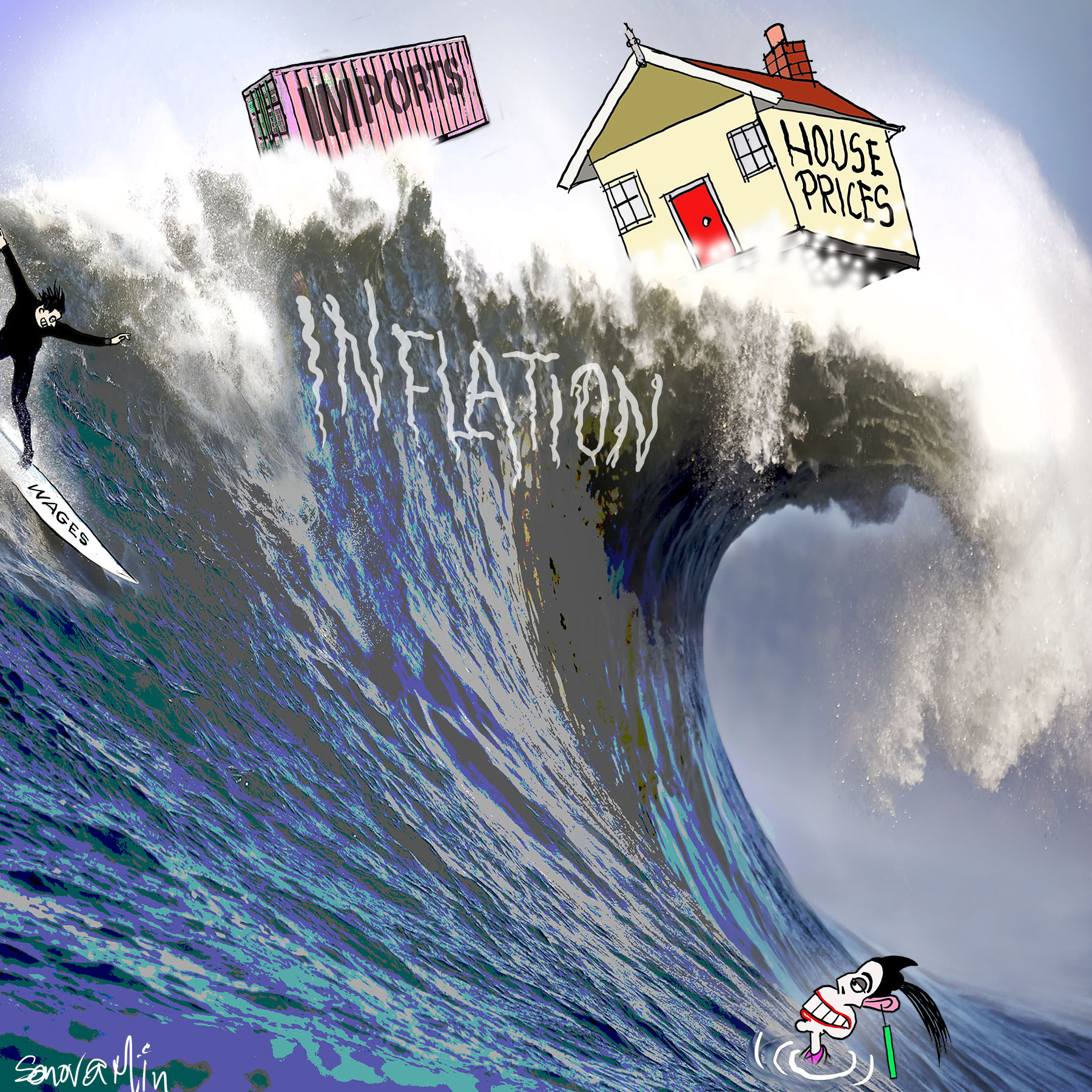

Remember, the housing market is still strong. Vendors are still getting record prices for their properties and, with dark clouds on the horizon, such as inflation and likely Reserve Bank actions on LVRs, the market may soften soon. This is a good time to sell. And sell they will. Landlords are selling in droves. The loss of interest deductibility might be, as they say, the straw that broke the camel’s back.

Interest rates are set to rise soon. Where will that leave landlords? Again, we all know the answer. It is a very good time to sell, but maybe not for much longer.

All of this means that the $800 million expected to be collected each year in additional tax revenue from landlords may be a pipe dream. And don’t forget, National has promised to reverse the tax when it gets back into power.

All of which suggests this ‘tax expert’ is not really much of an expert at all. She may understand the transfer pricing rules better than most of us, but she needs to take off her red-coloured blinkers and understand that there are consequences to everything – consequences that are often not foreseen.

Please share this article so that others can discover The BFD.