Sir Bob Jones

nopunchespulled.com

On face value the government’s attack on new residential landlords by denying interest deductibility has merit. The initiative will achieve its goals of lowering prices and also make it much easier for owner-occupier home seekers.

It’s difficult to argue against these steps as the current situation is crazy.

Where the government has hugely erred is saying this deductibility rule will also apply to all existing residential landlords within four years. That’s dumb (and dishonest) on a number of counts.

First, the hundreds of thousands of current residential rentals will be forced to go on the market.

That will crash all house values which is not something the two thirds of New Zealander’s owning their homes will rejoice over. In other words a stupid political move.

Second, it’s retrospective legislation which is morally reprehensible, plus a significant broken election promise of no new taxes.

Remove the private landlords who rely on capital growth as the cash returns are theoretical rather than actual and who will end up having to buy most of these houses to cater to the 25% of the population incapable of surviving on their own initiative?

The answer is the state, no less, or in other words, the taxpayer who have to a large degree been subsidised by private landlords, given the lousy cash returns.

To summarise; to end current buying fever, the initiative placed on future buyers is sensible. Conversely, extending it to all existing residential landlords within four years is mind-blowingly dumb.

What particularly irks me though is that all of this is not addressing the principal issue, namely a massive shortfall of housing stock.

I’ve written before how this could be overcome within a year by contracting one of the giant Chinese construction companies to deliver up say 20,000 homes.

Finally, there’s the old law of unintended consequences which will come into play in a big way.

Take the current large-scale boom in high-rise apartment construction.

There will be an enhanced rush of investors into these because as new-builds the interest is deductible and thus the demand impetus will drive up their values. But ultimately it will bring about an over-supply and, as always throughout history, see developers going broke.

However, therein lies another problem and that is socially, the most important requirement is not for high rise apartments but for state houses targeting low income families.

The political consequences of this non-interest deductibility will be bad for the government.

The majority of New Zealanders own their home and will have gained an enhanced sense of financial security through the recent years shortage driven value growth. They won’t take kindly to watching their principal asset sinking in value.

This is a huge windfall for the Nats. They should back the first part of the initiative because it’s worthwhile, namely non deductibility for future purchasers of existing rental homes, but undertake to wipe out the non-deductibility for existing rental home owners.

A major concern is, as investors rush to get out they will give their tenants notice so as to tidy the houses up for sale. Thousands of renting families will be on the street.

The government should rethink the second retrospective part of this initiative as it promises chaos and a worsening housing crisis.

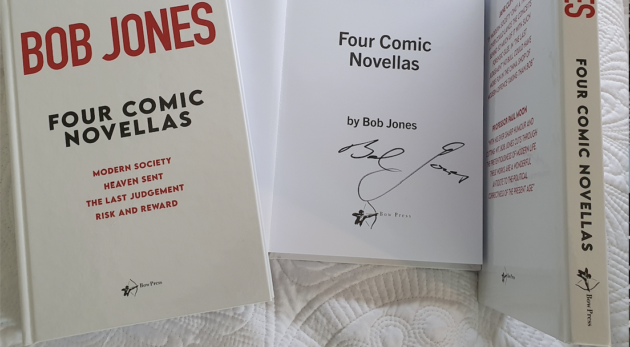

BUY Your Own First Edition Hardcover Signed Copy of Sir Bob’s Latest Book Today.

Please share so others can discover The BFD.