Lindsay Mitchell

lindsaymitchell.blogspot.com

Social Security benefits were legislated in 1938. The Labour government harnessed the collective financial power of all workers to provide for those who fell on hard times through no fault of their own (quite removed from today’s premise where own-fault is ignored).

Participation was a personal process with each citizen having their own recorded contributions and a pocketbook notating them. The money originally went into a distinct fund from which the government invested. State forests for example. It started going into the consolidated fund during the sixties.

It all worked well for a period. People had common values and didn’t abuse benefits. They had been bruised by the Great Depression and the First World War.

But a ‘free’ money genie can never be kept in a bottle.

As societal values changed, calls for greater widening of the safety net came. For instance, Family Benefits were relatively (but decreasingly over the years) generous and paid to the mother. But only married mothers qualified. Resistance to benefits being restricted to the nuclear family grew and from the mid 1960s all mothers qualified.

As communities became more tolerant of human frailty, especially drug addiction, sickness and invalid benefit qualification criteria loosened.

That’s just two examples of how social security has evolved.

Add in another compounding condition. The more normalised benefit dependence became, the greater the uptake.

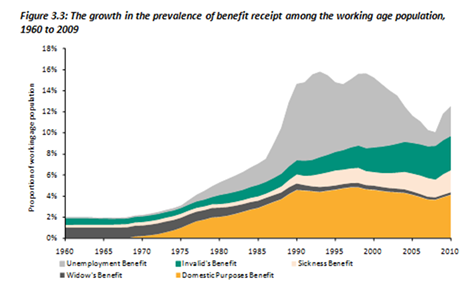

The recession of the late 1980s wrought havoc and receipt blew out in the 1990s to eye-watering levels. While academic lefties will tell you that the welfare state was dismantled under Roger Douglas and Ruth Richardson that’s rubbish. Yes, some cuts to rates were made (but eventually effectively restored via other new forms of second and third-tier assistance). The Family Benefit was abolished but half of the savings were redistributed to needier families (a little known fact). While numbers relying on an unemployment benefit gradually fell uptake of the other three – Sickness, Invalid’s and Domestic purposes continued to climb.

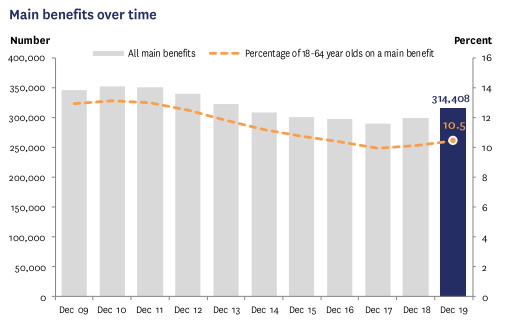

This century receipt had gradually declined (after the GFC spike) but only to levels viewed as reasonable when compared to the early nineties, not the 1960s or 70s. Dependence is still historically high at around 1 in 10 people.

The current Labour government was in the process of turning the downward trend around. More people were accessing benefits despite the unemployment rate being low and jobs plentiful.

And that was before Covid.

Now? Here’s a few future scenarios.

Social security is the greatest $ liability the government has, though the majority was in Superannuation. The wage subsidy is heading towards the total annual Super bill. Means-testing and lifting the qualifying Super age cannot be avoided. New Zealand was out of step with Australia, the US and the UK anyway in not raising the age. Though everyone seems to have forgotten we still have a rapidly ageing population.

With dwindling income ACC will seek to offload as much of its caseload to MSD as it can, increasing pressure on the MSD budget. At the same time more people will pile up on the sickness-type benefits as the health system struggles either playing catch-up after weeks of unnecessary inactivity or coping with new Covid outbreaks. The payment rate of the highest paying benefit, the Supported Living Payment, will drop.

There will be cuts to the accommodation supplement as the property market adjusts downwards.

More assistance will be provided as repayable regardless of whether that prospect is realistic.

As the imperative to get anybody they can into work ramps up the sole parent benefit will go. Paying people to look after their own children will be seen as a luxury.

Instead of the current move to NOT chase fathers for child support, the reverse will occur.

The lower age limits for benefits will rise and families will be expected to provide for previously independent children.

Working for Families will be severely curtailed.

Paid Parental Leave axed.

That’s just a few possibilities.

Social Security is the very opposite of its name. It is not secure. It relies wholly on revenue from taxation or borrowing. It’s sustainability cannot and should not be taken for granted as we go into a depression of unknown depth and extent.

It won’t matter whether the government is Labour or National. The former will just delay the inevitable.

If you enjoyed this BFD article please consider sharing it with your friends.