Sir Bob Jones

nopunchespulled.com

For centuries syphilis was a huge killer, especially after the First World War. Then in 1928 the Scottish virus researcher Sir Alexander Fleming, accidentally discovered penicillin, the world’s first and still most used anti-biotic. At last, it seemed the scourge was over. But alas, not so for it subsequently re-emerged and annually kills up to 200,000 people.

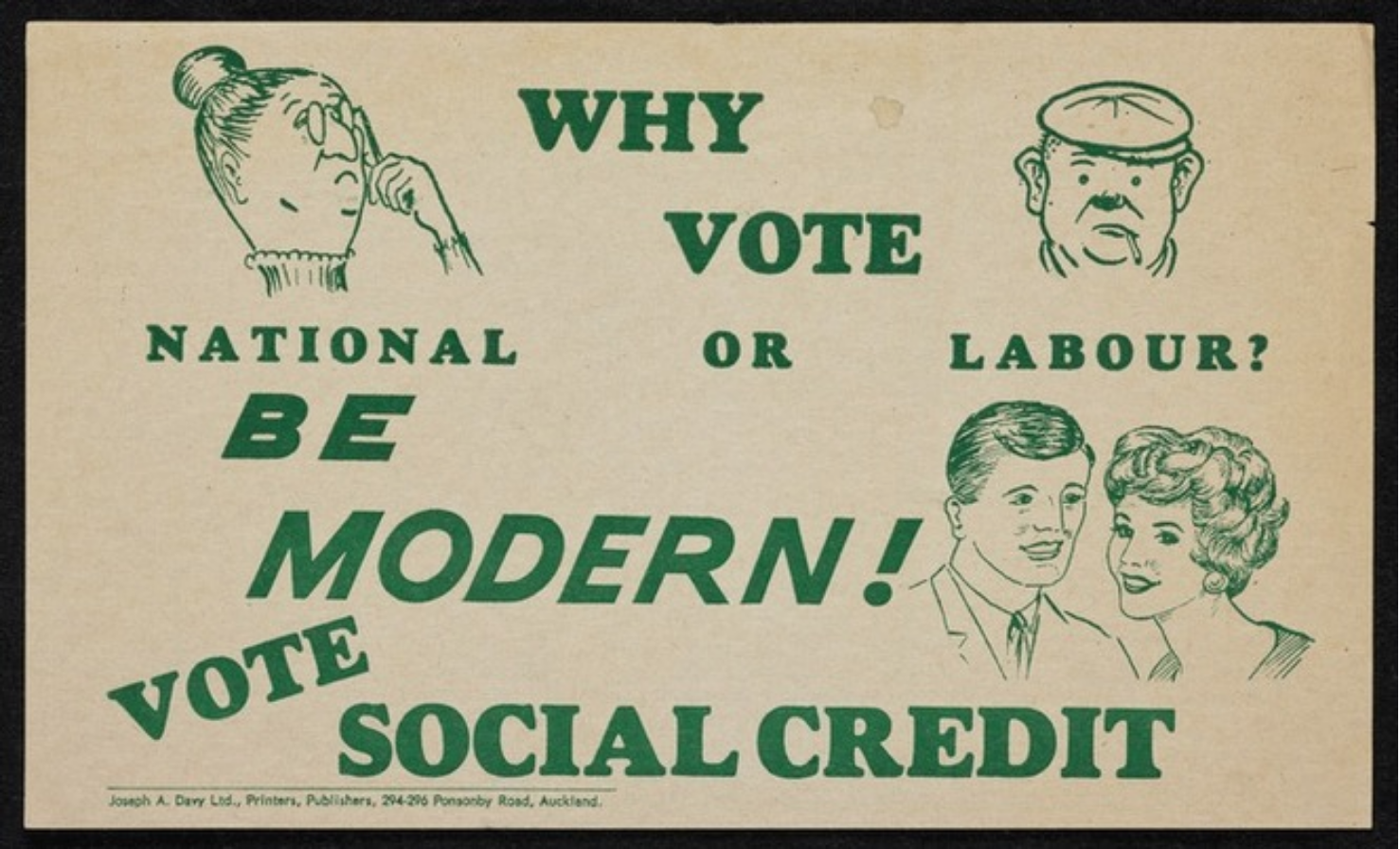

I thought about this recently when out of the blue, full page newspaper advertisements appeared across the land by the mad Social Credit movement, the syphilitic element of our political history. Every time we think we’ve stamped them out a few years go by then as with syphilis, up goes their coffin lid and zombie-like, they stalk the land again.

That said in their heyday, circa 1981 when traditional National voters, dismayed by Muldoon but who couldn’t bring themselves to vote Labour, ticked Social Credit and they rose to 21% in the polls.

They were all stark raving mad. The movement became a sort of social misfits organisation. I could tell so many funny stories about them.

In the late 1970s Truth (then our largest sales newspaper) political staffers demanded and received danger money to attend their national conference, and not without reason.

But now they’re back again, with full page advertisements quoting various economists to support their free money theories.

They include Shambles Eaqub, forever being quoted and who comes across as a nice enough fellow, and Bernard Hickey, noted for his gloomy economic forecasts.

Both made headlines, from recall about 2012, when they forecast a massive Auckland house price crash. So they sold up and shifted to Wellington whereupon almost overnight Auckland house prices began a boom unprecedented in history.

Also, getting an airing was Bryan Gould, who wrote a highly amusing contribution in the NZ Herald a couple of years back, asserting the Bank of England claims trading banks create money. The Bank of England said no such bloody thing. Gould doesn’t know the different between cash and credit.

If trading Banks can create money why do they borrow it and why do they go broke? Such elementary questions plainly never crossed Gould’s mind.

Economist Bryce Wilkinson gave them a roasting in the press following this latest emergence, reducing to tatters their propositions. But it won’t stop them. Decades will pass and then one dark and stormy night, up will go the coffin lids again. It’s whack a mole territory.

Their basic proposition is it’s silly to borrow abroad when we’re perfectly capable of printing our own money. And so we are so why not print enough to give everyone say $20million each?

Now there’s a good idea.

After all, the other commentators they quote in their advertisement argue a simple proposition. That is print our own money and cut out the middleman (the foreign lenders) and give it to the government to spend.

To be consistent, why not then cut out that government middleman and give it direct to the public? That’s perfectly feasible. $20million each ($25m for maoris naturally) and everyone’s rich.

But instead of taking the piss, here’s an elementary question I’d like the economists who’ve been quoted in the Social Credit advertisement, to answer.

Your proposition is, I’m sure you will agree, fairly elementary and hardly above anyone’s head. That being the case, explain why you think the whole world and not just New Zealand, has never implemented it?

If you enjoyed this BFD article please consider sharing it with your friends.