OPINION

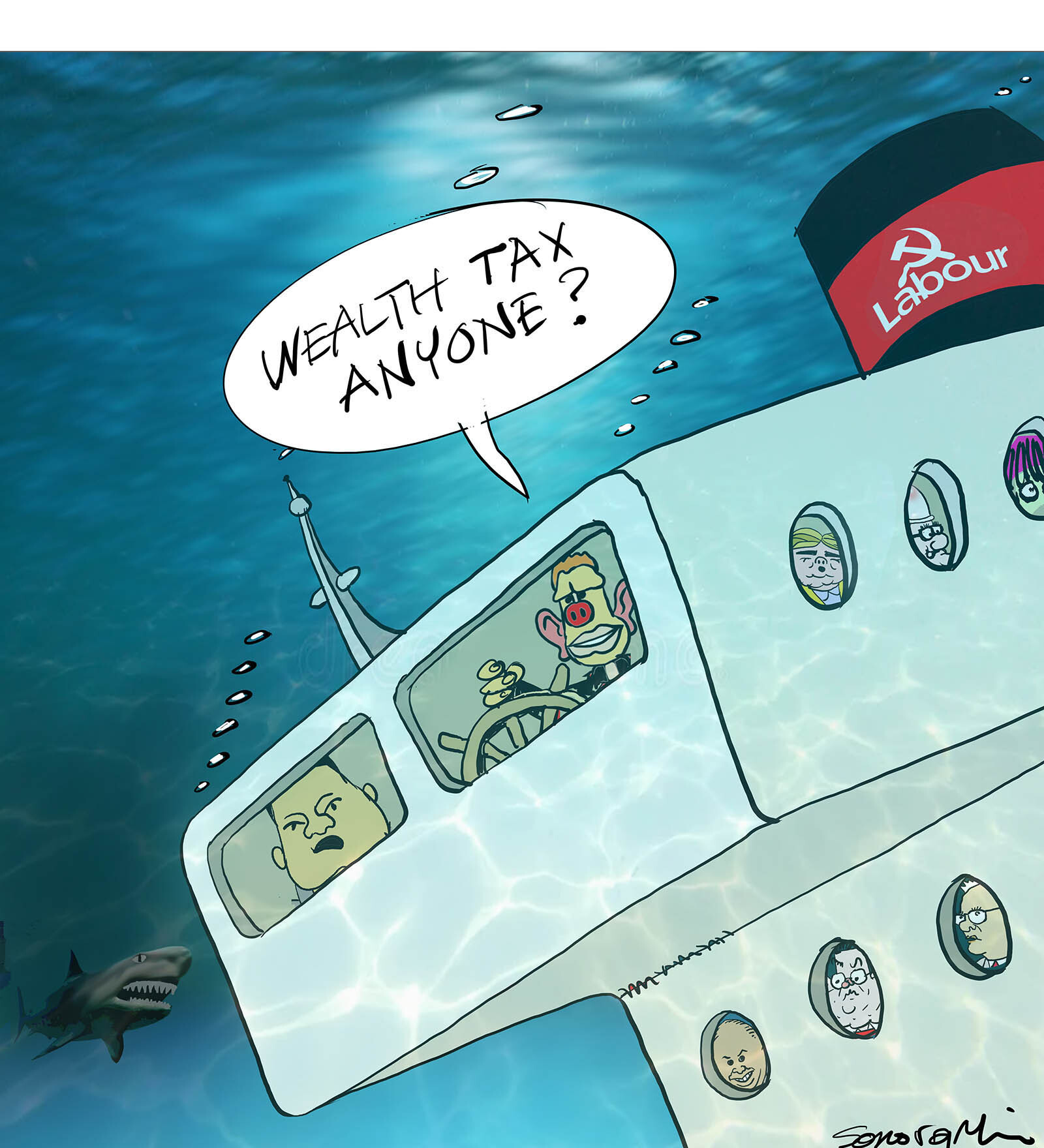

Failed Labour nonentity Grant Robertson made a comment in his valedictory speech to parliament saying the tax system is very unfair. Let us take a look at that contention and see if there is anything in it. One of its implications is the usual socialist chestnut that all your money belongs to the state, but if you’re a good little slave they’ll let you keep a bit of it.

This country is unusual by world standards in that there are almost no tax deductions and tax breaks for rich people to cook the books: the only tax break that exists is charitable donations. In other countries there are always 1001 ways to cook the books and shelter large dollops of your income from the taxman. This hasn’t been the case in New Zealand since the tax reforms of 1986 and claims to the contrary are simply false. Labour repeat this lie because they know their supporters are basically unquestioning and motivated by envy so they will believe it.

In New Zealand, 39 cents in the dollar is 39 cents in the dollar and this is a vastly different situation from Australia or other countries we compare ourselves with. In these countries wealthy people’s effective tax rate – after cooking the books – is probably no more than 25 per cent – vastly lower than here. And so Grant Robertson’s claim is simply untrue, just as his belief that men can get pregnant and have babies is also untrue.

In New Zealand let’s say you earnt a lot of money. You pay 39 per cent in income tax, live on a chunk of what’s left over, and invest the rest. That invested money – let’s say it’s in shares – doubles in value. You’re allowed to keep all the upside because there is no capital gains tax, nor should there be. In other countries if you earnt a lot of money you’ve only paid, say, 23 per cent in taxes, invested a chunk, it doubles in value, and so they clip the ticket on that capital gains because everyone knows you cooked the books in the first place – which doesn’t happen in New Zealand. Sounds to me like we have a very fair tax system.

Perhaps Robertson is simply annoyed lots of rich people are much more honest and better investors than, say, his daddy (but I digress).

The arguments put forth for a capital gains tax is it will somehow reduce poverty. This is a puzzling contention because every other tax hasn’t done so. The only way that would occur is if you were to match people up. We introduce a capital gains tax, each investor is matched up with a poor family. The investor then becomes responsible for this family, by slipping them a few quid every time he sells some shares. Or something of that nature. I simply do not see how else a capital gains tax would eliminate poverty; this is yet another badly thought out left-wing soundbite. The downside of this is that ‘middle New Zealand’ would come face to face with poor people and see first hand how parasitical, indolent and simply ghastly many of them actually are. You slave your guts out, invest some money, hand over a slice to some very rotten people who micturate it up against a wall then ask for more. Yes, that’s going to work brilliantly. Almost as well as every other socialist policy.