Sir Bob Jones

nopunchespulled.com

Retired Auckland lawyer David Schnauer, instead of taking up line dancing or acquiring a stable of mistresses, has foolishly instead, opted to spend his remaining years pontificating about the economy. In a recent amateurish contribution in the NZ Herald he bemoaned the sale of New Zealand businesses to foreign buyers. God help us. Where do I start?

First; we live in a global economy. Ban foreign buyers and foreign nations will ban New Zealand investors. For every dollar I’ve ever made in New Zealand I’ve made five abroad, much of which I’ve repatriated back here.

The incoming 1983 Hawke government banned foreign purchasing of prime Australian CBD buildings, cynically playing on economic nationalism as a populist ploy, contrary to all Australian government expert economic advice.

This nonsense lasted about five years before sanity was restored but was a boon for me with such massively reduced buyer competition while it lasted. That’s because I got round it by sending Frank, our in-house accountant, to the Foreign Investment Review Board (FIRB) in Canberra to plead for an exemption when buildings I wanted arose. Frank could drone on in a low monotone for literally hours on end.

I described this as my “Boring to Death” strategy as the only way Frank would stop is when FIRB agreed to our purchase. It could have been more accurately described as “The reign of Terror” tactic for after FIRB’s first taste of Frank, all subsequent requests for him to “visit to justify” a new acquisition resulted in near hysterical phone calls agreeing instantly to our proposed purchases.

Back to Schnauer’s economically naïve nonsense. These sold abroad businesses were not owned by New Zealand as he claims. They were owned by individual citizens who were free to do what they like with them, including selling to the highest bidder, whether from Te Kuiti or Mars.

Schnauer wrongly attributes the off-shore sales to a lack of finance in New Zealand. What absolute cock! New Zealand investors can readily tap into foreign lenders for such purchases. The fact is foreign buyers were prepared to pay more, often without regard to common sense normal investment criteria, motivated by easy access to capital. History will show many have massively overpaid and will be badly burnt by the imminent euphemistically described “correction” of investment assets values. In recent years these have ignored all economic rationality.

Schnauer trotted out the unmitigated nonsense of Muldoon’s 1975 abolition of compulsory superannuation as the source of our lack of capital claimed problem. He doesn’t know what he’s talking about.

That Labour government creation, in the words of Roger Douglas in 1974, would provide opportunity to invest in risky ventures shunned by financiers. Roger subsequently saw the light re this fool-hardiness. Super funds both of necessity, and by law, must confine their investments to low risk outlets such as government bonds and the like, and not pursue risky ventures.

The 1974 compulsary Super Fund appointed a totally ill-equipped investment manager who before the Fund’s closure by Muldoon, managed an initial “investment,” an absolute dog in fact, namely an ill-designed, poorly located new Lower Hutt office-block, now worth a fraction of its initial cost in real terms, assuming anyone would buy it.

Finally, Schnauer gave us that hoary old claim of money going into housing being lost to the economy. Far from being lost it’s the opposite. The “economy” is about our citizens welfare and their first priority is having a home. He’s confusing the problem of soaring house prices with the otherwise excellent goal of home ownership. His general assertion relegates individual citizens’ expenditure of their own earned money as almost traitorous in not instead investing in diverse activities for the perceived greater good of the economy, or in other words, everyone else.

David Schnauer should take my advice seriously, namely as a retiree on the last lap of his life, not waste it on hand-wringing about everyone else’s activities. Instead he should mind his business and build a stable of mistresses, all readily willing and available should he care to look. He will be an immensely happier man for it.

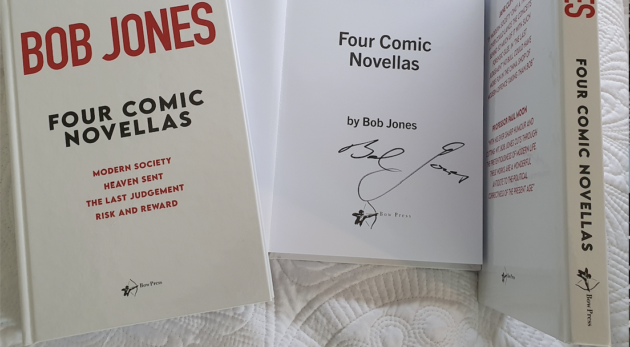

BUY Your Own Copy of Sir Bob’s Latest Book Today.