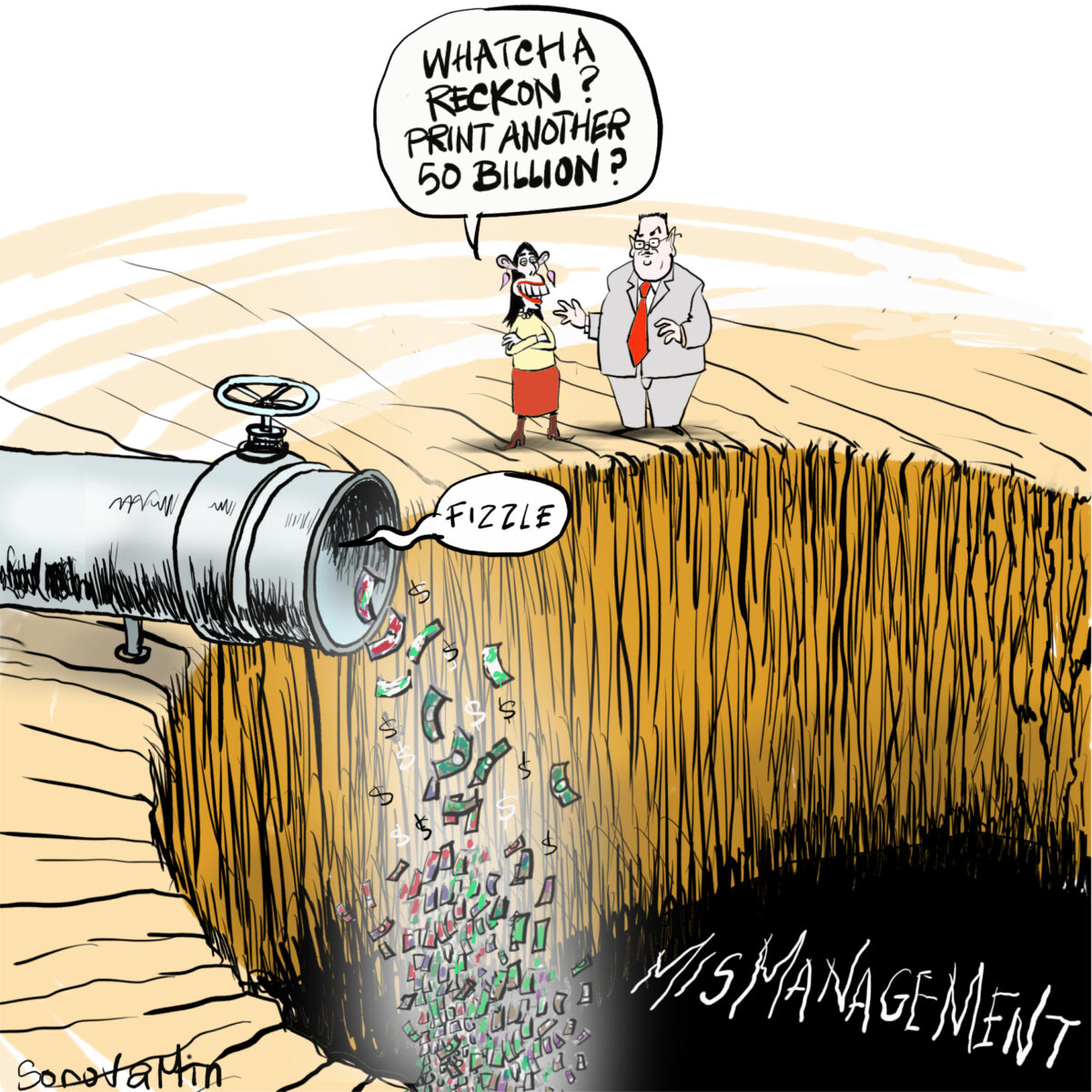

In June of this year, government debt had ballooned to $102 billion, from $58 billion in 2019. Yes, there has been a pandemic, and the cost of wage subsidies, business support, medical equipment and setting up testing stations and MIQ has been considerable, but this was a huge jump by any stretch of the imagination. Since then, with the Delta outbreak, the government is apparently borrowing to the tune of approximately one billion dollars per week, which means that our debt must be at about $120 billion by now. We seem to have lost all perspective over this figure and it is rarely talked about. But we need to talk about it.

Sure, further subsidies, a national vaccination programme and huge incentives to try to bribe certain sectors of the population to get the jab are by no means cheap, but if our debt has just about quadrupled in two and a half years, there are stormy days ahead.

The trouble is, it isn’t over yet. Delta cases are still rising, Auckland is still effectively in lockdown and while Jacinda sometimes makes noises about how Aucklanders are doing it tough, nobody seems to have really thought about what the effects of all this are going to be.

We seem to have completely forgotten about our tourist industry, once the country’s biggest export earner, now in ruins because of closed borders, and the same can be said about our international education sector. Don’t get me wrong – I’d love to see universities stop chasing the yuan and go back to doing what they should be doing, such as achieving excellence in education, but nevertheless, this is more millions that are lost to us for the foreseeable future. If you think, as I do, that this is going to have a devastating effect on the economy for the next few years, then surely you are right.

Clearly, though, not everyone thinks that way.

The New Zealand economy has remained resilient despite the Delta outbreak and is well placed for a recovery in 2022, Westpac economists say in a new report.

Record prices for agricultural exports coupled with ongoing strength in the domestic construction sector will enable the economy to maintain momentum, Westpac’s quarterly Economic Overview says.

A cooling in the housing market and the subsequent slowing in the rapid increases in household wealth could also dampen household demand.

Still, Westpac is forecasting solid average annual GDP growth of 4.6 per cent in 2022.

Are we talking about the same place? While they do refer to inflation, they never even mention Crown debt in this article, and they completely ignore the effect that quantitative easing has had on inflation, as it always does.

“We’re forecasting a series of OCR hikes over the coming years, with the cash rate to peak at 3 per cent in 2023.”

“We’re forecasting the inflation rate to peak at 5.1 per cent in the December quarter, and remain elevated over the coming year.”

NZ Herald

5.1%? This is an understatement, surely? You only have to look at the supermarket prices to realise that costs have increased considerably over the last few months, with fuel cost increases, supply chain issues and general increases. I truly doubt that we are at the end of it yet.

One thing that the NZ Herald article fails to mention is the possibility of another COVID outbreak, resulting in more lockdowns. We are seeing this happen in Europe as they go into winter, and there is no reason to think it can’t happen here. Auckland isn’t even out of its current lockdown yet, so how exactly Liam Dann and Westpac can be quite so chipper about the resilience of the economy, I am not sure.

Certainly, we are not alone in our economic woes, as many countries are now facing spiralling debt, high inflation and supply issues, but New Zealand, being a small country at the bottom of the globe, is at particular risk. It is very easy, because of our size, to cut us out of a supply route if demand is high elsewhere.

We simply do not have the tax base to pay off large amounts of government debt quickly, meaning we may be saddled with very high debt levels indefinitely, or increased taxes, or both. And while we have good agricultural exports, high prices for our goods and a recovery based on a building boom, spare a thought for the cafes, restaurants, hairdressers and other retailers in Auckland who have not been able to work for over 3 months. This is not a minor thing; they are part of the economy too, likely to be affected as inflation bites, so effectively they are going to be hit twice. This must affect hundreds of businesses and thousands of workers, and should not be swatted away as if they don’t matter.

Photo by Adam Winger. The BFD.

I don’t know where we are going with all of this, but one thing is for sure. All the talk of a great economic rebound is frankly premature. We are not out of the woods yet, and we are not a great economic powerhouse. We are vulnerable to trade winds and the failure of trade deals. All this economic optimism is, quite frankly, puerile. Once again, are we being fed the line that the government wants us to hear, rather than anything resembling the real situation? Frankly, you have to wonder.