Morris 8

Morris 8 is a veteran motor industry insider, a small-c conservative, fiscally dry but socially liberal. Loves New Zealand, but hates the current slide towards separatism and socialism.

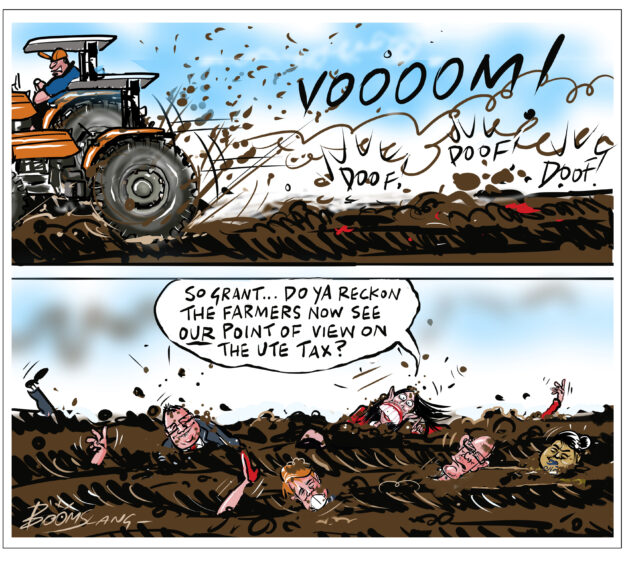

Farmers and people living in rural New Zealand are upset about the proposed “ute tax” elements of the government’s proposed Clean Car Discount legislation, currently being pushed through Parliament. The agricultural sector has realised that the vehicles they need for their work and businesses have been deemed “less desirable” and are going to be taxed disproportionately under the scheme. The revenue collected is intended to pay incentives and rebates to people purchasing more desirable low emission and electric vehicles.

It’s a classic case of a government using taxation for social engineering: rewarding people who follow the preferred direction and penalising those who don’t. It’s a small step along the way towards China’s “Social Credit” system, where every citizen’s behaviour is monitored and then rewarded or penalised according to the Communist Party’s guidelines. The rewards can mean access to better education, jobs, and housing; the penalties can include travel restrictions, and failure to be promoted.

I’m not suggesting that there is some master plan underlying the New Zealand government’s Low Emissions Vehicle Feebate scheme, the so-called “Clean Car Discount” proposal but once governments start using tools and levers such as taxation to re-engineer society, it’s a slippery slope downhill towards China’s Social Credit policies.

So rural New Zealand has identified that they are on the wrong side of this proposed legislation. Their work vehicles are going to be penalised when there are no viable alternatives to choose from. Farmers and tradies are upset, and rightly so. But they’ve only seen part of the first phase of the government’s plan to reward and penalise.

There is not just one layer of tax, not even just two. But three separate taxes designed to influence behaviour in terms of vehicle choice.

The first, as discussed, is the Clean Car Discount scheme. It’s been partially implemented already, with discounts for people who have purchased the right sort of vehicles: low emitters and electric vehicles. The penalties that the farmers are getting upset about will come early next year once the necessary legislation has been passed. The Clean Car Discount scheme will affect vehicle choices at the time of purchase.

But there’s a second step: the Clean Car Standard, set to be implemented the flowing year. This is a similar scheme, with penalties and incentives for “overs and unders”, to be calculated at the time of importation. The importers and distributors of new and used vehicles will be subject to penalties for every vehicle they import which is over the desired fuel economy standard and rewarded for every vehicle they import that is under the standard.

So a double whammy of taxes and discounts: firstly, at the time of importation, to influence the range of vehicles imported and offered for sale, and then again at the time of sale, to influence consumer choice. All of the costs are going to flow through to the end user, the consumer or business who buys the vehicle. A double layer of taxation.

If farmers and tradies are annoyed about the first stage of the ute tax, wait until they understand what’s coming at them: this second layer of taxes. The Groundswell protest movement will surge to include people from urban areas, as well as the rural base of the movement.

But wait, there’s more! The government hasn’t finished with their efforts at social engineering through taxation. The carbon tax on hydrocarbon fuels is set to increase, under the provisions of the Emissions Trading Scheme. The cockie or tradie who buys a regular ute or van for their everyday business use is going to get hit three times: a tax loaded onto the cost of the vehicle when it’s imported, an additional tax at the time of purchase and registration, and then a third time, every time the gas tank is filled, paying the increased carbon tax.

Not just an additional tax, not just a double whammy, but a triple whammy. The government will be triple-dipping into the same pot: taxing until it hurts, or until people change their behaviour.

It was put to the minister responsible for implementing these schemes, the Minister of Transport, the Honourable Michael Wood, that these additional costs are not “unfortunate by-products of the initiative, they are its purpose.” He agreed with this analysis and comment. It is the government’s deliberate intention to hurt people enough financially to force them to change their behaviour.

Social engineering by taxation.

Please share this BFD article so others can discover The BFD.