Grant Robertson must surely believe in fairies, pixies and unicorns. His ‘BludgeIt’ makes some astonishing assumptions in order to magic up results. Steven Joyce outlines just how magical the thinking in the ‘BludgeIt’ is:

First, our economy is apparently going to grow faster than Australia’s in three of the next four years. Given where we are both starting from, with Australia growing at the end of last year while we shrank, that seems ambitious. Add in the key differences between our respective economies and it looks a bit more so.

Really? How is that going to happen? Pumping billions of dollars of borrowed money isn’t going to grow the economy, nor is piling huge costs onto employers, landlords and the productive sector.

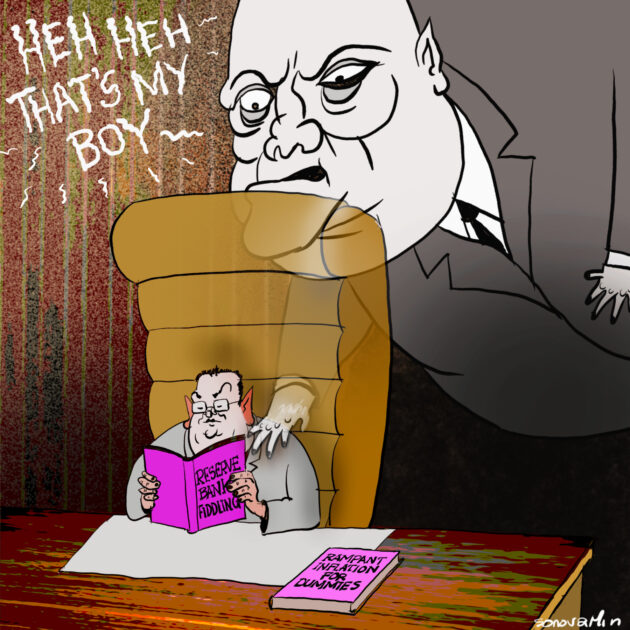

Then there is the matter of inflation and interest rates. Inflation is going to tick up in the September quarter, but will then remain very benign for the next few years. According to the economic outlook, the Reserve Bank won’t be forced to raise interest rates off their historic lows for the next three years. This rosy view is not unique to New Zealand policymakers, but no less courageous for all that.

Commodity prices, meanwhile, are going to continue to rise. All the extra money washing around the world is going to keep flowing through to our commodity export prices, while magically not flowing through to consumer prices here or anywhere else. That will be quite impressive to see.

Add in the billions of borrowed cash and the spectre of hyperinflation beckons. Strangely, Grant Robertson seems to believe that his actions of flushing billions into the economy won’t see inflationary pressures occur.

The assumptions around house prices are also quite magical. The new government interventions in the housing market are going to help bring house prices perfectly under control. We will go from a 17 per cent increase in house prices this year down to just 1 per cent next year, and they will stay like that for years afterwards, neither overshooting on the downside or the upside. And all without any material change in mortgage interest rates.

It is almost criminal what Labour is claiming regarding house price inflation. If you believe that house prices will only rise by 0.9% in the next year then you probably also believe Labour will build 100,000 houses in ten years.

Another assumption in the Budget documents is that the Finance Minister is going to show much more fiscal restraint in the future than he is today.

This year he has truly opened the financial spigots. The Government is spending nearly $20 billion more over the next four years as a result of decisions made in this Budget, which equates to around $5b a year. That’s over $10b more than the minister signalled he would spend as late as December last year. Though again, none of it will be inflationary.

Yeah right. Nothing robs the poor like inflation does.

Grant Robertson’s redux of Muldoon style economic policies will deliver up simultaneous inflation and recession. They are destroying industries and printing money.

And last time this happened we almost had a civil war known as the Springbok tour.

The sad thing is that at least Sir Robert Muldoon had an accountancy qualification. Even a history degree like Dr Michael Cullen had, meant he didn’t repeat the mistakes of the 1970s when he was in charge.

I can’t wait for a return to carless days, petrol rationing and wage and price freezes including rent controls.

Please share this article so that others can discover The BFD