John Ling

wealthmorning.com

John is the Chief Marketing Officer at Wealth Morning. His responsibilities include marketing, customer service, and compliance. He is an experienced investor and portfolio manager, trading both on his own account and assisting with high net-worth clients. In addition to contributing financial and geopolitical articles to this site, John is a bestselling author in his own right. His international thrillers have appeared on the USA Today and Amazon bestseller lists. John is a shareholder of Wealth Morning.

Smartphones. Computers. Televisions. Cars. Planes.

What do they all have in common?

Microchips. Or if you want to use a more fancy word for them — semiconductors.

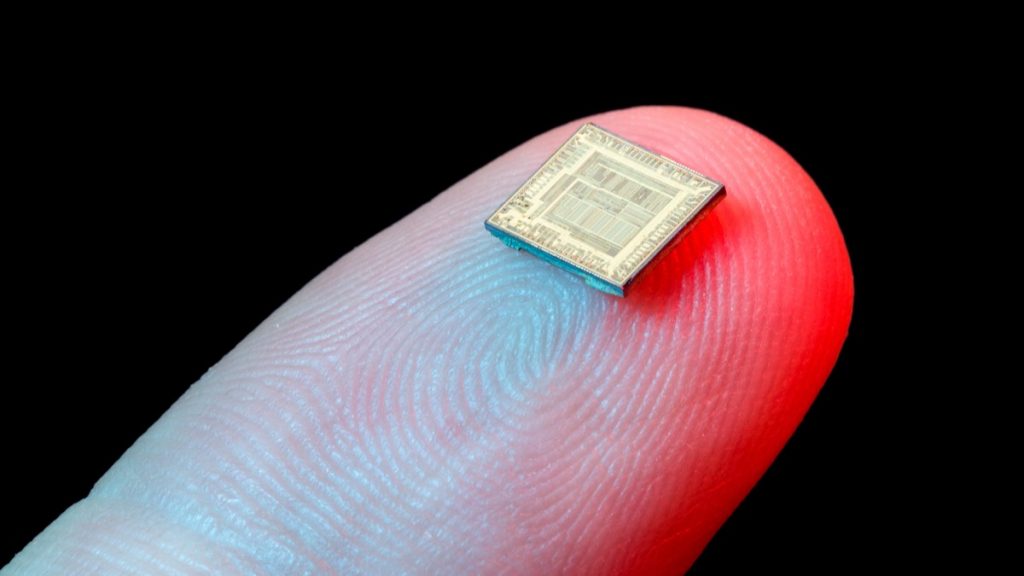

They are small. Invisible. Operating out of sight.

We often take them for granted. We don’t even stop to think about them. But here’s an undeniable fact: We rely on electronics. And electronics, in turn, rely on semiconductors.

Without these chips, our modern life would sputter and grind to a halt. Maybe even collapse.

Right now, that’s the nightmare scenario we’re facing.

There’s a chip shortage happening worldwide, which is paralysing a whole range of industries.

Just how bad is it?

Well, here’s a taste:

- At Ford [NYSE:F], they are experiencing a manufacturing crisis. Their popular F-150 pickup trucks can’t roll off the assembly line because they don’t have electronic modules. The company’s solution? To build and store half-finished vehicles, suspending worker shifts until production can start moving again.

- At Nvidia [NASDAQ:NVDA], they are experiencing a huge bottleneck. They can’t create enough graphic processing units (GPUs) to meet consumer demand. This is having a direct impact on sectors like video games and cryptocurrency mining. In desperation, the company is now being forced to recycle and sell older models of their GPUs.

- At Samsung [KRX: 005930], they are experiencing a massive logistical blow. They want to launch their latest Galaxy Note smartphone, but with this chip crunch, they are being forced to hit the brakes. Worst-case outcome? Their flagship product may not make its debut this year.

Over and over again, this is a story that’s being repeated all over the globe. Supply lines are being squeezed. There are not enough microchips to go around. Everyone is feeling the stress.

So, how has it come to this?

Certainly, the pandemic is to be blamed. The lockdowns we faced in 2020 have had a flow-on effect on manufacturing and shipping. It’s like a string of dominos tumbling, one after another.

But there’s also a wider geopolitical struggle happening. Tensions between America and China have reached boiling point. Both now play a game of brinkmanship — and the fight over chip supply is at heart of this confrontation.

How? Why?

The American Dilemma

Read the mainstream news, and you could be forgiven for thinking that Republicans and Democrats are poles apart when it comes to ideology.

After a contentious presidential election last November, the far right is consumed by conspiracy theories, while the far left is obsessed with wokeism and cancel culture.

But take a closer look at mainstream conservatives and liberals. The ones who operate in the middle. You will find a very curious thing: Both sides are actually in agreement about the threat of an ascending China. They have expressed a fierce desire to do something about it.

In February, a bipartisan group of lawmakers met with President Biden. It was an urgent meeting with a critical point on the agenda — the global chip shortage.

Three important points have been raised:

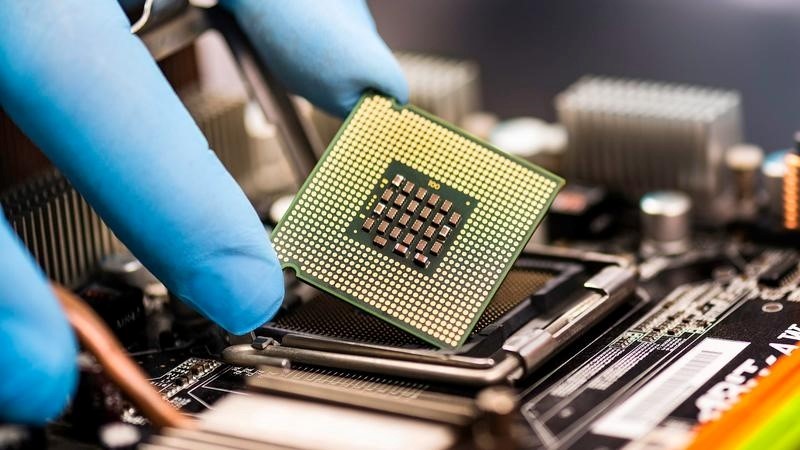

- America is home to some fantastic semiconductor companies. In fact, 47% of the global chip market is effectively American-controlled.

- However, here’s the dramatic twist: Only 12% of the world’s chips are actually manufactured domestically.

- A whopping 88% of America’s semiconductors are made in foreign countries. This includes mission-critical chips used in the defence industry.

It’s clear: America’s supply chain is vulnerable. The ‘just in time’ approach to logistics isn’t ideal anymore.

So the White House has responded with an executive order. An excerpt here:

The United States needs resilient, diverse, and secure supply chains to ensure our economic prosperity and national security. Pandemics and other biological threats, cyber-attacks, climate shocks and extreme weather events, terrorist attacks, geopolitical and economic competition, and other conditions can reduce critical manufacturing capacity and the availability and integrity of critical goods, products, and services. Resilient American supply chains will revitalize and rebuild domestic manufacturing capacity, maintain America’s competitive edge in research and development, and create well-paying jobs.

Read in between the lines, and you’ll understand what this means: Biden intends to bring American semiconductors home, potentially in a big way.

This is ambitious, but it won’t be easy.

Decades of globalisation have unspooled supply chains across the globe, like strands of a spider’s web. It’s stunningly complex. Reeling them back will take time.

The Chinese Dilemma

It may feel like a lifetime ago, but it was only in 2001 that China joined the World Trade Organization. Ironically enough, this happened as the result of American sponsorship.

It was hoped that China’s entry into this New World Order might pave the way for the widespread liberalisation of its economy and society.

20 years on, the opposite has actually happened. China is more authoritarian than ever before, and its ultranationalists have a score to settle with the West.

But in the race for supremacy, China faces the exact same problem that America does: It doesn’t have complete control over its ‘just in time’ supply chain.

In fact, in the world of semiconductor manufacturing, it’s actually two smaller countries in the Asian region that consistently punch above their weight: Taiwan and South Korea.

Astoundingly enough, two companies — Taiwan Semiconductor Manufacturing Company [TPE:2330] and Samsung Electronics — control over 70% of global manufacturing.

They run what is known as ‘foundries’ — where semiconductor designs from both East and West are outsourced to for manufacturing.

In other words, the same Taiwanese and Korean chips that power American brands like Apple [NASDAQ:AAPL] are also the same ones that power Chinese brands like Huawei.

China recognises that this lack of self-sufficiency is a vulnerability. For this reason, it has made efforts to move away from its dependence on foreign foundries. It now runs its own foundry — the Semiconductor Manufacturing International Corporation [HKG: 0981].

However, the consensus is that the chips made in China are of inferior quality. Foreign supply chains are still needed. This is now made more difficult by the fact that America has placed China on a ‘trade blacklist’ — effectively strangling access to semiconductor materials.

The World Holds Its Breath

Singapore prime minister Lee Hsien Loong has warned that a physical clash between the two superpowers is more likely than it was five years ago.

It’s a timely observation.

The jitters are now being felt throughout the Asian region — and China’s neighbours are reacting accordingly.

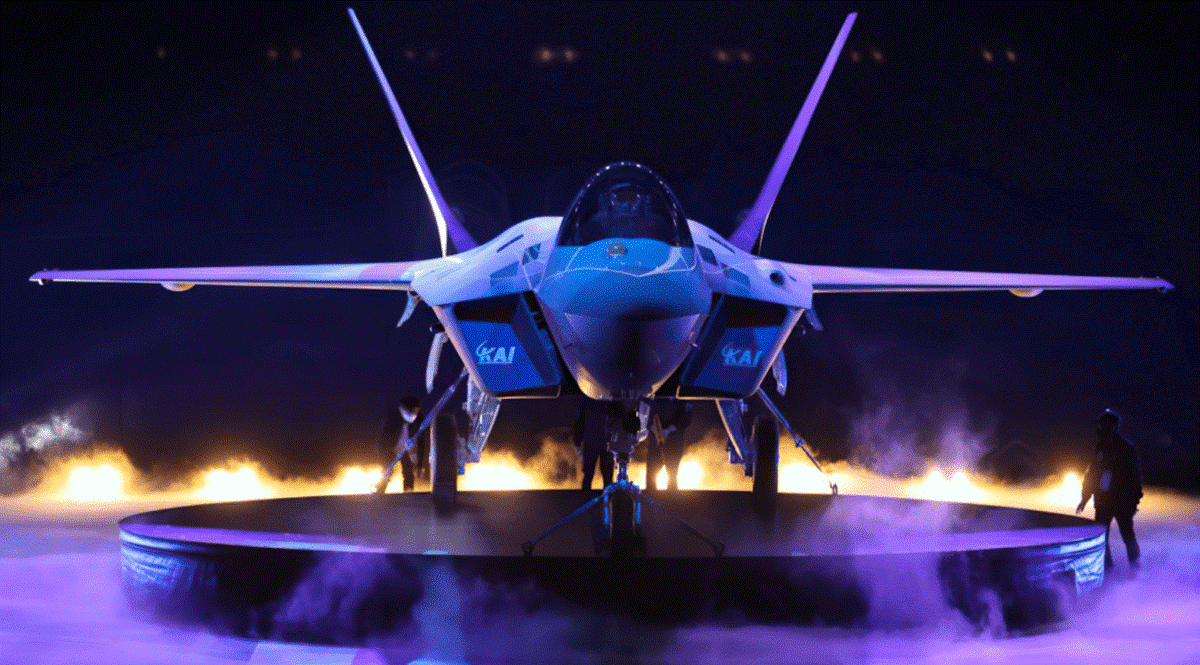

Just this week, South Korea unveiled their KF-21 Boramae (Hawk) fighter. It’s an advance supersonic fighter designed to act as a deterrent to China’s rising military.

South Korea plans to export the KF-21 to other Asian nations that might likewise feel threatened by China.

Meanwhile, tensions over Taiwan continue to simmer.

China has moved an aircraft carrier close to the island nation, buzzing Taiwanese airspace with military jets. America has responded by inching in with a carrier of its own.

Is this a prelude to hostile action? Or just posturing and bluster?

China regards Taiwan as a rogue province to be brought under its control. It has expressed a desire to do so by force, if necessary.

But here are the strategic problems:

- How will China capture Taiwan without damaging its semiconductor infrastructure?

- Will the cost of an actual invasion actually be too high?

- Will aggression actually harden attitudes in the region against China?

It’s clear that this Great Chip War is just getting started.

The weeks and months ahead will be critical to what the endgame looks like.

And we’re watching closely.

Please share this article so that others can discover The BFD.