Westpac economists expect house prices to level out over the rest of this year and expect “moderate” falls in the coming years as longer-term interest rates eventually rise.

They also say renters can stop worrying about the prospect of rents rising significantly, despite threats from disgruntled landlords.

Acting chief economist Michael Gordon even said some of those landlords might be wise to look at selling to their tenants.

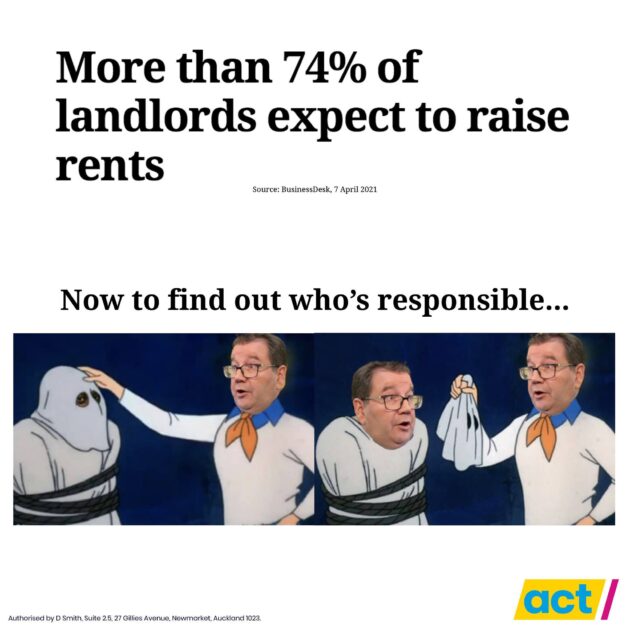

Really? Can renters stop worrying about their rents going up? I think you’d be a pretty brave renter to dismiss rising rents as a possibility, or foolish.

In fact, from what I’ve seen from the Westpac economists, I would suggest it might be a better policy to dismiss their ramblings altogether.

I think it may have been Sir Bob Jones that once suggested that if you want to get ahead in life, do the opposite of what the economists suggest, as they are invariably wrong. I would also suggest that not only are their predictions usually wrong but they are usually about 180 degrees out.

A recent survey conducted by the New Zealand Property Investors Federation showed that, across 1,719 respondents, property owners expected their costs to increase by an average of $3,140 per year per rental property.

Are they really expected to just suck up $60 per week? Maybe they will for a little while but as soon as they can, they will be jacking the rents up to match.

Of course they may not be able to do that straight away but as sure as bad Labour Party news is buried in the 5 pm Friday releases, it will happen.

Well known ‘Rent-an-economist’ Shamubeel Eaqub said investors could find it harder to raise rent than they expected. Rents were not usually set according to investors’ costs, but instead driven by the limit of what tenants could afford to pay.

“Rents are set at what the market will bear,” he said. “People will charge the maximum they can get in the market.”

Eaqub is somewhat correct here in that it is indeed the market that will set the rent, but it is rarely set by what the tenant can afford to pay. Social Housing tenants for instance simply apply for a greater accomodation supplement to cover rent rises; other tenants may bring in another flatmate to help cover the extra.

What really drives rents, is availability. Right now in many parts of New Zealand, there is an abundance of available rental properties. Queenstown is a classic example. Where in the past there were very few properties available for long term rent, those rents were sky high. The median rent for a 4 bedroom house in the area was slowly creeping up to over $900 per week prior to last year’s flu season.

Now that median is down to $750 per week, simply because the town is dying through lack of tourism. Last week, a young lady I know and her boyfriend bargained a very nice house, in a nice part of town, down from $750 per week to only $600 per week. She was able to do this because they are reasonably desirable tenants, with good jobs, don’t smoke meth and weren’t planning to put 15 South American flatmates in there with them. And it was most certainly about the fact that there are currently plenty of rentals available and definitely not, as Mr Eaqub would have you believe, down to how much they could afford.

But make no mistake, as soon as tourists start coming back to Queenstown, and all those hotel cleaners, rental car shufflers and bar staff come back to work, the demand will shoot up and so will the rents.

And now that those people are all going to be getting more money in their pay packets as a result of the latest minimum wage hike, you can be assured that there will be plenty of landlords all too willing to grab a share of it. This of course has already been seen in Wellington when the Labour led coalition gave students another $50 each week for housing. In that case the economists were right for once, in that the landlords raised rents based on the potential tenant’s ability to pay more.

So are all these tenants likely to be in a position to buy that rental from the landlord? Extremely unlikely I would suggest. Quite how many people might be furiously saving for a deposit in this current uncertain environment, one could never know, but with your average starter home in Queenstown now in the $900,000 range, good luck getting that deposit together!

I guess there may be a few landlords who might consider selling to their tenant, perhaps through loyalty, or a desire to help them out, but the reality is that most people selling a house try to get the maximum price for that property. Sure there will be a few who can’t be bothered with the hassle and will take an easier but likely lower value deal, simply to keep life simple, but they will be few and far between.

So don’t feel bad if you tend to ignore the witterings of the so-called ‘Economists’. It seems they may simply have been put on earth just to help prove the old adage that you can’t really succeed in life if all you have is book learning.

Please share this article.