Sir Bob Jones

nopunchespulled.com

The financial markets have never been more irrational. All sound traditional valuations are out the window in a classic tulip mania scenario.

Driving this is world-wide Central Banks money-printing, currently four times greater and rising, than that which followed the 2008 banking crisis. That exercise had a single desirable goal, namely to save the vitally important banking system, failing which we’d have faced an unthinkable disaster.

But it took five years for that liquidity to ultimately feed into share-markets and commercial property, driving yields down and prices up. The difference this time is the newly minted money went direct to the public, mainly in wage subsidies, and thus has quickly fed into the system.

So our share-markets are now operating solely on the bigger fool principle, that is ignore all normal value criteria and just buy as purchasers coming behind you will continue to drive up prices. Note I say prices and not values.

Nothing epitomises this insanity more than Bitcoin.

The true value of Bitcoin is zero. There’s a very good reason for that, namely it’s not actually being used as an alternative currency, which is its rationale, simply because it’s highly inefficient.

Some defenders have compared it to gold, arguing that gold similarly has no income-producing character and is merely a time-proven safe haven asset. That’s rubbish. It’s not a question of producing income, rather throughout human history gold has been, and remains, the foremost ornamentation material.

And it’s not just India in which every woman craves its acquisition for ornamentation, but a global age-old fact. A gold watch is viewed everywhere as superior, so too rings and numerous other things.

The gold medal indicates the best, not just in the Olympics but as a figure of speech, thus gold-plated, golden opportunity, gold standard, golden boy and so many similar terms reflect the value humans have always placed on the metal.

But Bitcoin has zero value, serves no purpose and is totally a reflection of the current speculative insanity in which all value criteria are ignored.

The fact that its promoters so frequently descend to fraudulent promotion says it all, this via the Internet.

I was a victim a year ago, with bogus advertisements on the Internet promoting it over my name. More recently other well-known Kiwi financial figures have also been subjected to this. That’s gone on world-wide.

Its defenders point to its prescribed limited supply as a reason why its value will increase. That only applies, (to repeat) if it actually has a function which it theoretically but not in practice does.

Here’s an illustration of that lack of logic.

I possess a right hand. It’s the only one in the world, not just now, but in entire human history and in the future, with its unique DNA.

If I had it amputated and stuffed then listed on the Stock Markets, can we expect frenzied bidding to drive its value ever upwards on the grounds of its uniqueness? The answer is no as it lacks the utterly bogus mystique factor currently surrounding Bitcoin.

The world’s largest Bitcoin so-called miner, Bit Digital, listed on the Nasdaq exchange, last week passed US $1.36b in market capitalism, its share-priced fueled by speculative mugs. Simultaneously a number of securities analysts declared it a scam.

Its chairman and CEO Zeng Erxin is now on the run from the police and a recently departed director plus its Chief Financial Officer are both in jail. Twitter has suspended its account and the company is being investigated in America for securities fraud.

Inevitably the day will come when the music stops and Bitcoin collapses back to its true value, namely nothing.

Over my life I’ve observed many insane speculative booms. Often-times early participants do well although mostly they became obsessive, believing they’ve discovered an infallible get rich holy grail. Invariably their obsession turns to dust as they lose their mania period gains.

Also, over my life I’ve watched lots of people become seriously rich, indeed I’ve done so myself.

Such people share common characteristics in their approach, namely hard work, patience and considered analysis, none of which are features of Bitcoin speculation.

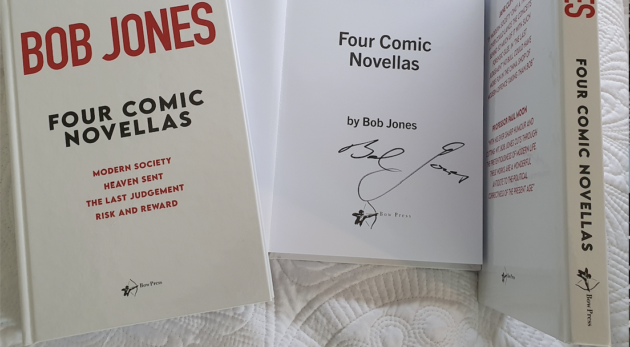

BUY Your Own First Edition Hardcover Signed Copy of Sir Bob’s Latest Book Today.

Please share so others can discover The BFD.