Get woke, go broke: it’s a truism that’s none the worse for being repeated so often. Truisms are just that, after all. With dreary repetition, corporations prostrate themselves at the altar of a loudmouth clique of leftist extremists and get hammered where it hurts: on the bottom line. Customers desert them in droves and money walks.

But then, some corporations are born woke. Contrary to the above truism, these have become some of the most powerful corporatocracies on the planet. But, as they ramp up their intolerant wokeness, are they finally taking it too far?

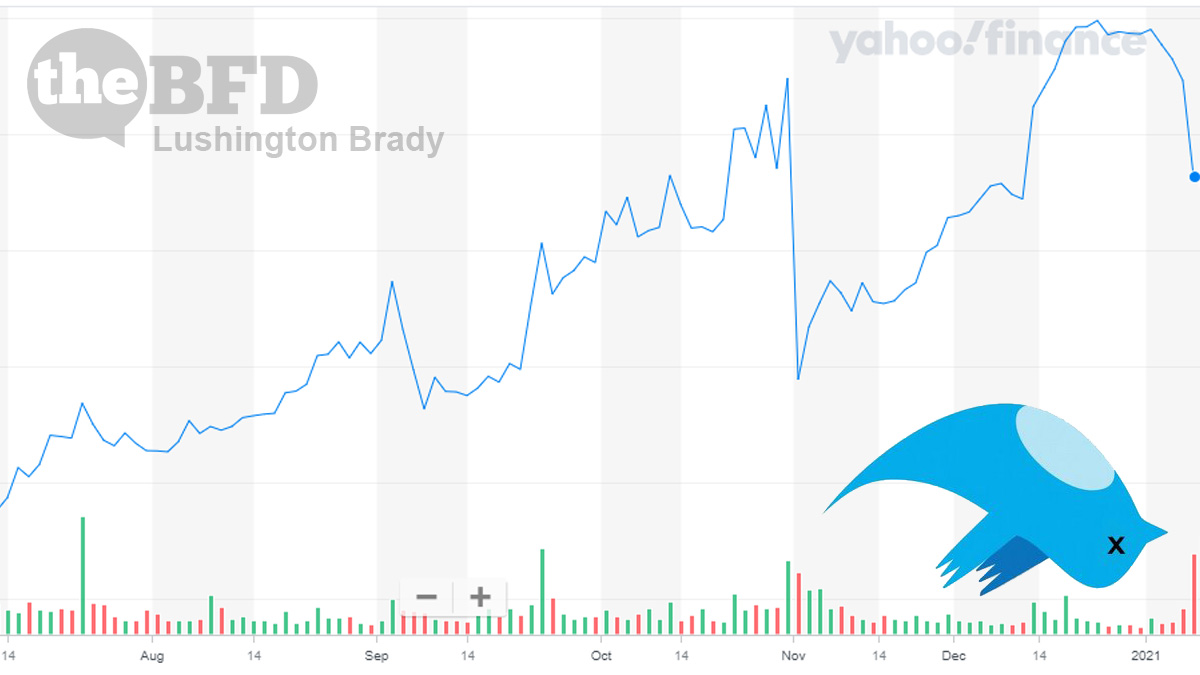

Twitter’s share price tumbled after the US company permanently suspended Mr Trump’s widely-followed account, spurring concern among investors over the future regulation of social networks.

Its stock plunged as much as 12 per cent, before it managed to recover some of those losses overnight.

Looked at short-term, Twitter’s financial picture has been patchy, but generally upward – but that’s only because it’s still recovering from a devastating collapse four years ago, when its share value plunged to just a tenth of its previous high. It’s still nowhere near its 2014 peak. While it’s recovered a lot of ground over the past year, the question is whether this week’s plunge is the beginning of another devastating fall.

The attention drawn to Twitter increased investors’ worries that it could be more exposed to regulation than its bigger rivals Facebook and Alphabet (the owner of Google and YouTube).

Friday’s move, accompanied by suspensions for some of Mr Trump’s supporters, was the first time Twitter had banned a head of state.

Apple, Alphabet and Amazon also suspended Parler, a social network favoured by many Trump supporters, from their app stores and Web-hosting services, effectively making the service inaccessible.

“These moves, whether you consider them justified or not, could well see them lose further users if they become seen as arbiters of what is considered politically correct or acceptable,” said Michael Hewson, chief analyst at CMC Markets UK.

Facebook similarly saw a fall in its share price, although not as severe, following its pre-emptive ban on President Trump. Alphabet (Google’s parent company) shares also fell slightly. If the backlash against social media censorship grows, even the biggest corporations might have something to worry about.

Republican politicians denounced the decision as an attempt to stifle conservative voices, and quell the President’s right to free speech.

German Chancellor Angela Merkel, whose relations with Mr Trump have been frosty, has also criticised Twitter’s ban and warned through a spokesman that legislators, not private companies, should decide on potential curbs to free expression.

Australian politicians have also weighed in, with Acting Prime Minister Michael McCormack accusing Twitter of applying double standards.

MSN

When even Angela Merkel is getting on Twitter’s case, is the jig finally up?

Of course, Australia’s cretinous left are happily drawing the noose of censorship around their own collective necks.

For the opposition, Labor leader Anthony Albanese said it was “about time” social media companies banned Mr Trump.

And when the last law was down, and the Devil turned on you, where would you hide…the laws all being flat?

– Robert Bolt, A Man for All Seasons.

Please share this article so that others can discover The BFD