With a cheerleading media failing to ever hold our hopeless government to account it pays to read international media to get some critical reporting on serious matters.

Our media are too focused on what Clarke Gayford tweeted or who Jacinda Ardern has hugged lately.

Meanwhile, our government is splurging out in a glut of unsustainable borrowing and spending. Bloomberg reports on the alarming development:

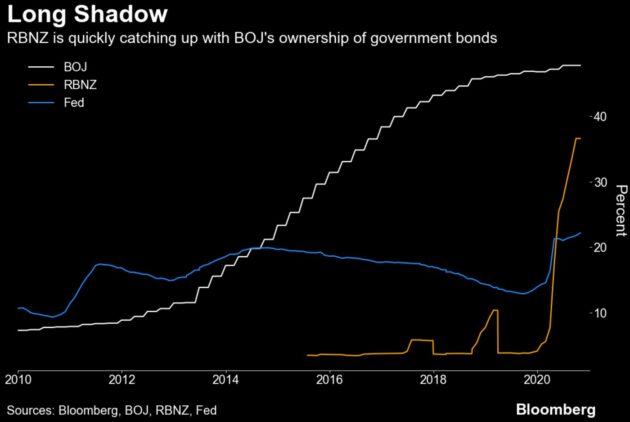

The Reserve Bank of New Zealand’s growing dominance of its bond market is sparking unfavorable comparisons with Japan.

The RBNZ’s ownership of the nation’s outstanding nominal government bonds has rocketed from 6% to 37% in the space of seven months, according to calculations by Bloomberg based on data from the central bank. It took Bank of Japan Governor Haruhiko Kuroda more than three years to reach this level, and his starting point was over 11%.

The ultra-aggressive quantitative easing program has helped to cushion the New Zealand economy, but as was the case in Japan, it risks killing bond market volatility, sapping trading interest and crimping bank earnings. A subdued market with depressed yields may also deter overseas investors, limiting foreign capital needed to fund the current-account deficit.

“The RBNZ is really the ‘kiwi whale’ from a bonds and monetary policy perspective,” said Prashant Newnaha, senior rates strategist at TD Securities in Singapore. “The risk is they’ll crowd out other investors. Yields may get to a certain level where investors question whether there’s any point in buying the bonds at all.”

I’m pretty sure that Grant Robertson is trying to find out just how far he can push things. The chart Bloomberg provides shows just how alarming it is:

In New Zealand the risk may be more that the RBNZ’s bond-buying program crowds out the foreign investors, who have been the biggest buyers of government bonds.

Of course, weaker global demand for New Zealand bonds may help contain any appreciation in the currency, which would support the central bank’s efforts to stoke inflation while lower yields revive economic growth.

This is crucial given that while New Zealand has succeeded in suppressing the coronavirus, border restrictions are likely to keep slowing the inflow of immigrants and decimate income from international tourism and education.

The steady inflow of students and immigrants has bolstered New Zealand’s economy and is a key point that differentiates it from Japan, said Toru Nishihama, an economist at Dai-ichi Life Research Institute Inc. in Tokyo.

“Should a prolonged slow recovery in the global economy from the pandemic change this assumption, there will be a risk that New Zealand’s bond market becomes like Japan’s,” he said.

Given the government’s ONLY response to the Chinese plague is lockdowns and tight border restrictions it seems inevitable that the easing of the border is a long way off, and therefore the very thing stopping us from the Japanification of our economy will come to pass, and doom us to a longer and harder economic recovery.

Let’s see how long it takes our news media to start reporting on this critically.

If you enjoyed this BFD article please share it with others.